Bill Mitchell: A job guarantee

The economist who coined the term MMT on his plan for full employment

If there are two big economics ideas that have fired up the popular imagination during the Covid-19 epidemic they are the universal basic income and modern monetary theory. And with the primary criticism of the first being the cost, the second - which claims countries with their own currency can never run out of money - would seem to provide the answer. But the Australian economist who coined the term MMT, Bill Mitchell, isn’t a fan of the UBI - a proposal he dismisses as an unnecessary surrender to neoliberalism.

I spoke to Bill last month and the T

he Spinoff have published an

article I wrote based on the interview. But there’s a lot that didn’t make it into that story so here’s a full transcript (edited slightly for sense ).

Can you start by telling me how you became interested in the issue of full employment?

If you think back to post war period, we had full employment in Australia and New Zealand. In Australia for example if unemployment went above two percent the government would run the danger of losing office - such was the social consensus. This Saturday [31 May] is a very interesting day because it’s the 77th anniversary of of the release on May 30, 1935 of the famous

white paper on full employment issued by the Australian government.

Most of the countries after the Second World War issued similar documents. These were the great mission statements of the post war consensus. They had understood that the Great Depression had only really ended when governments started prosecuting the war and bombing the hell out of each other. And the challenge for the peace time after the war was how are we going to maintain the full employment that we’ve created and got rid of the Depression. What they realised was that they could do that through the use of fiscal deficits and appropriate infrastructure programmes and employment programmes. So these white papers - and they were called various things in different countries - but they laid the blueprint for government taking responsibility for full employment: a job for all. And governments all around the world signed up to various treaties - like the UN Human Rights Declaration and the International Labour Organisation’s declarations and we saw this period where everyone could get a job. There was no under-employment …

There is a caveat on that isn’t there? It was white men who could get a job?

Yeah, I’m not talking about Nirvana here. I’m talking about an approach and a consensus that was for the times, relative to social attitudes. And clearly we had a change in social attitudes in the early ‘70s and that brought women into the workforce and gave them new freedoms. So I’m not saying that the 1950s, for example, was a utopian stage in our western world - far from it. We had racist attitudes, we had xenophobia….

But there would have been the capacity to employ everyone who wanted a job?

My view is, of course. The only reason that full employment consensus delivered operationally - in other words sufficient jobs for those who were lining up for them was that the public sector basically ran an implicit buffer stock. Now in Australia - and I’m pretty sure the same sort of structure operated in New Zealand - you could always get a job in some public sector area. Like the transport system, the railways, the local governments, housing, roads and maintenance. All of the big infrastructure that were in the public sector in those days, telecommunications all were able to to provide jobs fairly quickly. So the railways were a great example.

Where I grew up in Melbourne you could always go down to the railway yards and get a job on any day you wanted. This buffer stock. There were always jobs there. Those jobs were low skilled. They were accessible to everybody. Whether you had a mental illness, whether you were unskilled, whether you had a criminal past. Anyone could get jobs on the rail in those days.

This was how we maintained full employment. We maintained it by strong spending in the private sector. We maintained it by career orientated public sector jobs but we also maintained it by having this buffer stock of jobs. And if you look around the world; Switzerland, Japan …. those who resisted the rise in unemployment in the mid 70s after the OPEC oil crises - the ones that separated from those that had very high unemployment were the ones that maintained that buffer stock capacity.

So would the railways, for example, do extra maintenance or lay new tracks at times of rising unemployment?

In some cases there were jobs like that. That ebbed and flowed with the state of the private economy. But in the case of other jobs they were more or less permanent.

As a young musician, who used to have a need for income occasionally, outside of the music, those jobs were loading goods trucks down at the old Melbourne terminals. They were just wheeling boxes and crates on barrows. That was it. Very unskilled work. But it was very inclusive work because everyone knew they could get a job if they were down and out on the rail.

That led me thinking about the fact nowhere in our history has the private sector ever supplied enough jobs relative to those who wanted them and the only way we could maintain was the state playing a central role. That was when I started going to university that was my thinking.

Then I did this course in agricultural economics in 4th year at Melbourne University and we went through the wool price stabilisation scheme. Now this was a scheme - unsure whether it was in NZ - but the Australian federal government ran a scheme to stabilise prices for farmers because the farmers had been lobbying the federal government to stabilise their incomes because they were sick of the fluctuations up and down. A bounty one year, a drought the next year. And the government agreed that when the wool clip was very strong and there was an excess supply into the market - relative to the demand that was being produced - the government would buy that excess supply and therefore keep the price stable. Match private demand with supply.

Is that a bit like the butter mountains we used to hear so much about in Europe?

That was European common agricultural policy and that was a different scheme really. The Germans were desperate to re-invent themselves as citizens of Europe rather than plunderers and the French wanted German growing industrial strength to subsidise French farmers so that’s how it the common agricultural policy really became the first major European unity policy but the point why it’s different is that it worked on subsidies, and subsidies just encourage over production. If you’ve got a per kilogram subsidy of course you’re going to produce as much as you can to get the subsidy.

The wool price stabilisation was different. We had these big warehouses all around Australia called wool stores. So the government would buy excess wool and store it and if there was a bad clip one year and there was an excess demand for wool - which had driven the price up - the government sold the wool out of their wool stores to meet that excess demand without forcing the price up.

This was late ‘70s I was doing this study and this was just after unemployment started to rise and neoliberalism started to become the dominant way of thinking about the role of government and it was the precursor to the privatisation and all of the deregulation. Unemployment had risen and that was due to the dislocation of the OPEC oil crises and the fact the government responded to those with austerity to stop the inflation and that pushed unemployment up.

So I was doing this course and I was studying this scheme and I wasn’t that interested in wool - I can tell you - but I was very concerned about unemployment which was one of the motivations for studying economics. I wanted to do something useful. So while I was doing that course I had this idea that if if the government can do that for wool and stabilise the price and effectively stop the farmers from losing income, why can’t they do it for labour? Why can’t they when there’s excess supply of labour - which is unemployment - and there’s no bid for labour in the private market, why can’t the government make the bid buy those labour services, put that labour to productive work - rather than wasted in unemployment and of course when the private market improved because the plan I came up with was to buy that labour at the bottom of the wage structure - so you weren’t competing for the private sector labour at private sector bids you’d just be putting in a bid at the bottom of the bid structure - the wage structure - and a result the private sector when it was improving again could just buy that labour back out again.

And the government in doing that wouldn’t be contributing to any inflationary spiral because it wouldn’t be trying to bid for resources at market prices and that would help solve any inflationary episodes.

The job guarantee

So are you saying it that it would be at the current minimum wage?

Not necessarily current … it would become the minimum wage … but at the time I thought the minimum wage was too low and that we would want to use this as an industrial policy as well.

It’s what I now call the social inclusive minimum wage. A minimum wage that allows a person to participate fully in society with dignity. Go to sporting events, go to musical events, go out to dinner occasionally, have a holiday and it would push the minimum wage structure up.

Let’s talk about right now. There’s never been a greater need in my lifetime, anyway, for what you’re suggesting. We’ve got a private sector that simply isn’t going to be able to do anything about the on coming wave of unemployment.

What are you proposing? Who would decide what the jobs should be? Is there a limit to how many jobs will be created?

No. The idea of a job guarantee is that it’s an unconditional job offer. At a socially inclusive minimum wage to anyone who to take that job. There’s no time limits…. It’s not a budgeted allocation and once that’s exhausted you finish. It has no job period. In normal times the pool of job guarantee workers would be very small and in bad times like now the pool would be very large.

And who decides what a valuable job is?

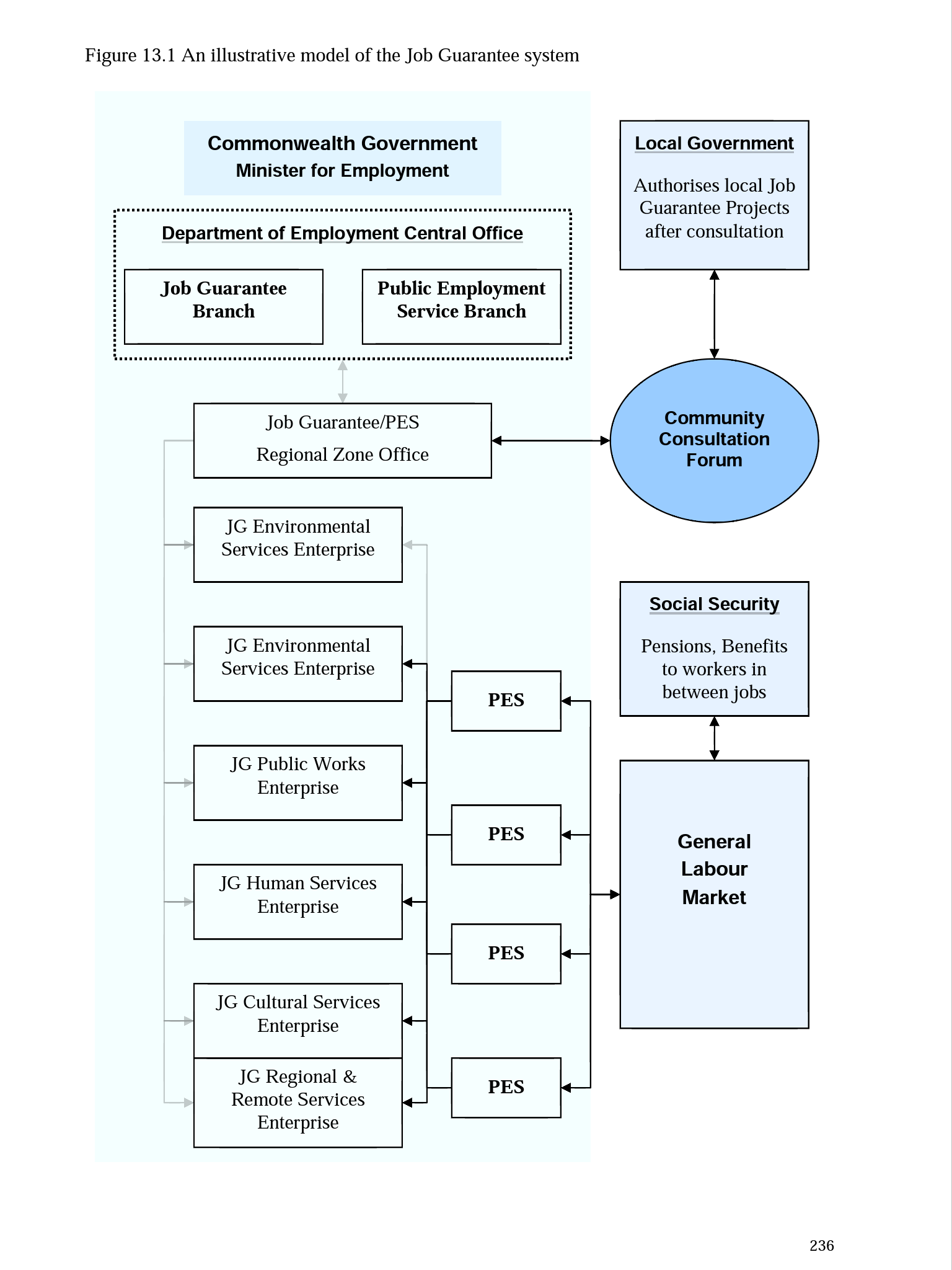

In the Australian context because of the federal system the federal government would pay for it because they have the currency issuing monopoly and the capacity and the operation details would be down the bottom at the local government area.

We did a large research programme - a three year research programme - where we surveyed all the Australian local governments and we asked them how many jobs could you design and oversee to meet unmet need in community services, environmental services and basic infrastructure services and we asked them to cost it and all the rest of it.

We got multiples above the current unemployment at the time. And so the way in which these things have to work is for local communities to identify unmet needs in their regions. You don’t want top down type imposition of what’s good and what’s bad for a community. So it’s funded at the top and driven at the bottom.

So could indigenous communities and schools, for example, be the ones allocating the jobs?

It’s an incredibly flexible structure if you think about it. In Argentina in 2001 when there was the big meltdown and they defaulted on a lot of debt and they had the bank runs and all the rest of it. They brought in sort of job guarantee programme - called

the head of household programme. And what they did there was offered a guaranteed number of hours of work a month to one member of each household as a sort of way to resolve the crises domestically. To sure up domestic demand and spending when their international economy had collapsed. They allowed just local communities. Streets to get together. Householders in streets to form little cooperatives to determine how the jobs would be created and what were valuable. And you got really creative solutions turning up. The big national job guarantee in India does a very similar thing. They allow local community. It’s a very flexible structure.

You could allow parents and teachers association at a school to say we want some work done and we can sustain jobs that aren’t going to be competing with existing jobs. So it’s not a structure that would undermine exisiting jobs and just replace jobs. There’s so much creativity can come out of this.

You can really push the agenda and I tease audiences by saying that - I live on the coast near some of the best surfing beaches in the world - I would offer job guarantee jobs to the surfers. Everyone says ‘What the hell has this guy gone crazy?’

They’ll say ‘What will they do? And I’ll say well they can going surfing - but yeah the other thing they can do - the big problem in our summers is drowning on our beaches. And who knows the water better than anybody? Who goes into the most dangerous parts of the water to get out quicker to the waves? It’s the surfers. So what could the surfers for a job guarantee which would be incredibly productive - they could offer water safety training to school children. And build an understanding of our beaches and our water and the way in which that works. That would be incredibly productive because it would reduce the strain on the emergency services, it would reduce the deaths during our summers. Who would oversee that? The surf lifesaving clubs could do that.

There was a Dutch scheme that provided a minimum wage for painters - and it ended up with warehouses full of unwanted paintings. A lot of artists are convinced they should be paid whether it’s for writing poems or painting canvases. How does a community decide who should be able to paint all day?

That sounds to me as though it’s a design problem that you don’t actually get productive output. For example I play in a band and a lot of people who play in bands in Australia are typically unemployed and they’re all low paid because of the nature of the industry. And at the moment the arts community is in crises because of the shutdowns. So I would hire all of the musicians and sculptors and artists and painters on the job guarantee if they wanted to have a job. Now what would they do? They would play their guitar and they would paint. But what else would they do? Well, here’s the design issue. The musicians could go into school and conduct their rehearsals in schools halls and children could sit around and watch the way in which music is put together. Doesn’t matter what sort of music whether it’s classical or jazz or whatever.

Children could ask musicians about their instruments and how they got motivation to do it. And all sorts of mentoring could go on which would create a new knowledge set and a new way of thinking. And increasingly what we’re going to have to do in our societies is broaden our concept of productivity.

Because we’re going to have to reduce our carbon footprint and we’re going to have to create low carbon industries to create jobs and income. The arts is a great way of doing that.

And all of these projects would end up stimulating the private economy because people would have money to spend?

Of course.

Our government has said it will spend $10 million locally in the search for a Covid 19 vaccine. Is putting a price tag on it simply looking at it the wrong way from an MMT point of view? Is it a capacity issue rather than a dollar issue?

Well the general principle is that you should spend within your constraints. The way in which that general principle is understood and expressed in the mainstream way is they think it’s a financial constraint. So they penny pinch. And they start going “oh god ten million that’s going to stretch this… blah, blah.”

But the New Zealand government issues its own currency. The NZ dollar. That’s their monopoly. And it’s like saying that two minutes into the second half of a rugby game the scoreboard sends out a message the game has to stop we’ve run out of points.

And the crowd would say, that’s ridiculous you can type as many points into the scoreboard - these days with electronics - as you want. The points are only limited by how many balls people can run over the scoreline.

And it’s the same with the NZ government spending capacity. It can put as many zeros and and ones into bank accounts as it chooses, that’s not the issue.

The constraint are the real resources that are available. The specific problem that you’ve got is are there scientists who can do that. And if you divert those scientists into that use from where they are from where they are now what does that do for general resource usage and would the income produced by that resource usage drive the spending of the economy of what the economy can produce.

So is this a case where according to an MMT way of think the government can create not only minimum wage jobs but high paying skilled jobs if for some reason the private sector isn’t employing those resources?

A lot of progressives think that the job guarantee is the job panacea. But as one of the developers of that concept I see it as being a very small part. A very important safety net. Because we know that when there are big downswings in economies the people that disproportionately endure the burden are the low skilled. My feeling is it’s much better for the world to have people to be able to have jobs when there’s a crises than to be unemployed.

So the job guarantee is a small but essential part of a civilised society but in general we want to aspire to much higher than that and we want to aspire to lots of skilled work, and high knowledge and high value added and high productivity work both in the private and the public sectors.

Who will do the shit jobs ?

If you have meaningful, useful work that you’re doing for a liveable wage it seems to me that will cause major problems for business owners when they try and attract people to work at, say, a McDonalds restaurant or deliver food. Companies are going to have trouble competing

If you go back to the true employment era vacancies always outstripped unemployment. And that created what I’ve called a dynamically efficient labour market because that forced the onus back on firms to produce interesting jobs, amenable working environments, good pay… Capricious employers would find it very hard to attract labour.

It was a win win for everybody because the firms were able to achieve high productivity and we had strong productivity growth in that era. That generated the capacity to provide high incomes and high incomes provide high profit.

Is that when the risk of inflation comes in? Because if businesses are competing for labour and need to pay more, which is one way to make a job more attractive, that could see prices rise couldn’t it?

That’s why I said the high productivity provided the space for the high incomes. Real wages and real incomes can grow within that productivity envelope without causing any cost pressures and in those days we had very few bouts of inflationary pressures, we had strong growth in real incomes and we had strong growth in productivity.

In my view the movement precarious work and the gig economy is unsustainable. It’s a race to the bottom that’s going to deliver us with ongoing chaos as we go forward. So a policy that puts the pressure back on employers - that if they want to stay making profits they have to restructure their work places to attract labour. We’ve had this situation where capital is not investing very much any more because they’re pushing more and more money that they used to invest in productive capacity and productivity augmenting capital they’re pushing it into financial speculation. Now that’s unsustainable. That’s not going to produce prosperous societies. It’s not going to deliver reduced inequality like we had in the full employment era. We’re seeing rising inequality. And eventually that creates social instability. And there’s a reason why in the late 19th Century trade unions were formed and governments were forced to create welfare states it was because society had had enough of the brutality of capitalism and they were prepared to maintain capitalism without revolution as long as the government mediated the greed and created a more equitable, more upwardly mobile environment.

We’ve gone through that period. Then we’ve had the emergence of neoliberalism which is retrenching a lot of those gains made and now we’re going to turn the circle again and we’re going to pressure government to look after us better.

What was it that caused the very high inflation in the late ‘70s?

In October 1973 oil prices doubled over night. It was part of the Arab resistance to the Yom Kippur war and the occupation and all of that stuff. The problem was that oil dependent countries - most countries - suddenly faced an imported raw material shock. So all of us faced and what that meant for all of our countries was that our domestic real income was now lower. So the amount of income that could be distributed to domestic claimants profits, wages were now lower. The question was how was that loss going to be shared and of course at the time the governments didn’t have the forethought to work through a machinery and institutional structure to solve that problem. And the trade unions were quite powerful in those days and price setting power was concentrated in the hands of businesses and employers and they had an almighty barney as to who was going to take the loss.

And you had a lot of real wage resistance which meant workers kept pushing up their nominal wage demand to protect their purchasing power and firms would push up their price margins to protect their profit mark up.

There was no institutional structure to manage the conflict over who was going to share the loss the imported raw material shock.

What’s wrong with a UBI?

What is it you don’t like about the UBI?

The way I understand the monetary system tells me that the currency issuing government like New Zealand can buy what ever resources that are available for sale in that currency - without question including all idle labour without question.

So once you understand that then you can immediately conclude one other thing which is that mass unemployment is a political choice. It’s not something amorphous, it’s not out of reach, it’s not something imposed on us by Mars. It’s a political choice and when there’s mass unemployment like there is now, government’s have deliberately chosen to allow that to happen because they could solve it.

So once you understand that through a combination of a job guarantee and higher skilled public service employment.

A lot of progressives are advocating UBI. Neoliberalism has built up this myth that governments can’t do anything about unemployment. That if they do - this is the NARU - natural rate of unemployment doctrine that underpins neoliberalism. And what they’ve told the public is that only the private sector creates jobs not the public sector. Well that’s a lie. And that’s because they’ve got an ideological agenda to strip the public sector of its capacity to increase the well being of of us and to use the capacity to create more capacity for the top end of town. That’s neoliberalism.

So when progressives promote UBI as a solution to poverty they’re really buying into the neoliberal myth that the government can’t create work. That somehow we’re powerless to do anything about unemployment and what we should be doing is solving the poverty problem of unemployment.

My view is that that is surrendering to the neoliberal argument. The whole of neoliberalism has been based on individualism and the break with the old concept of collectivism and the old idea that there was such a thing as society. And society was enriched by us working together in collective ways and understanding that occasionally the system would fail. And the way the neoliberals have constructed unemployment is as an individual failure. It’s the failure of people to skill themselves up or look for jobs properly. They’re lazy dole bludgers.

Now my view of unemployment is it’s a systemic failure to create enough jobs. It’s a failure of policy ultimately. Once the non government sector has made its spending and that’s generated sales and jobs, what’s left over the public sector’s responsibility.

This idea that all you have to worry about is yourself, I just want to do my art - I keep hearing that among the UBIers - I just want to be creative …. Well that’s a surrender to this individualism. While you’re doing your art, who produces the food? Who runs the buses? Who makes your art supplies people who have got work.

The third problem I’ve got with it. It constructs the individual really as a consumption unit. So all you’ve got to worry about is giving an individual who we’re depriving the opportunity to work - we’ll give them a dollop of money so they can keep consuming and keep the surplus generating process going. We don’t care about them as social beings, we’re denying the fact that work is much more than just earning income. In all of our societies it’s a way that we measure our self-esteem, our contribution, where we meet our future partners, where we form social groups, where we achieve entity and whole and our self-confidence and our meaning in a way.

Now we can broaden the concept of work but if we just isolate people in unemployment, their social networks shrink and they lose meaning, they lose self-esteem and they become really introverted.

And what the UBI is saying is we’re just going to give them an income to prop up their consumption.

They have this utopian idea that all these people are going to burst forth in creativity and find their true selves. What unemployment does in a society that still values paid work as exemplar of contribution all you get is people alienated and dislocated from society.

That creativity won’t emerge. It’s much better to have full employment, broaden the scope of what we mean through public sector employment by productive work and over time shift the way we think about contribution and being and meaning in work.

Do that within a paid work environment you won’t be able to achieve that in a non paid environment. We as a society are not willing to accept able body people, or people who want to work - even those with disabilities who want to work - we’re not willing to accept them getting cash from the public sector for doing nothing.

If we ignore your philosophical and moral assumptions and just say is it possible - using an MMT understanding of the monetary system - to pay for the UBI: what’s your answer?

No question you can pay for it. And the UBI advocates have done themselves no favours by adopting all the neoliberal myths about whether the government can afford things.

The debates about the taxes required are irrelevant. They come up with these elaborate how to pay for schemes which force the employers to pay taxes and all these weird schemes.

The question is then how much you’re going to pay. With a job guarantee you’ve got what I call an inflation anchor. Why? Because if there’s inflationary pressure within the economy the government can always redistribute workers with tighter fiscal into the job guarantee pool and because they’re buying a fixed price, the redistributing workers from an inflating sector to a fixed price sector eventually you solve the inflation pressure.

With a UBI if there’s an inflationary pressure all the government can do is cut back the UBI or redistribute workers back into unemployment. So in other words, the UBI has no inflation anchor and essentially adopts the neoliberal inflation control mechanism which is using unemployment as a policy tool rather than a policy target.

To avoid that they’ve got to set the UBI very low which doesn’t solve the poverty problem.

The role of tax

So the role of tax as MMT sees it is, one: to take money out of the economy if you start to reach an inflationary point; two: to redistribute wealth, and three: to discourage activities you may not like… so carbon taxes and that sort of thing. Is that it in a nutshell?

There are a number of reasons. One if the resource allocation reasons. That is if you don’t want people to smoke or drink to excess put a tax on it. If you don’t carbon polluters to go wild put a tax on it. So in other words you push the price up and reallocate resources to other things.

In MMT taxes play an extra role. Take two scenarios. Scenario A is you have lots of idle resources like you have now. What are the constraints on government spending in that context? None.

No financial constraints no real resource constraints. And so the NZ government should be spending more and more to bring those idle resources back into productive use. Up to the point where there are no more idle resources, then you hit the constraint.

Scenario B is that point - you’ve got full employment. Then if the government wants to run a green transition programme it’s going to have to increase the size of the public sector, it’s going to have to fundamentally transform production and consumption patterns, so it’s going to want to command more real resources. So if you’re at full employment already and the public sector wants to get more real resources into the public sector if it tries to compete for those resources in the market by bidding them up at market prices and saying to labour we’ll pay more you’re getting currently then it will cause inflation. So what does it have to do? It has to deprive the current users of those resources of that use. How does it do that? Reduce the current users’ purchasing power. How does it do that - a number of ways but a really powerful way is to impose taxes.

Do you have a favoured tax?

I favour the taxes that are most simple to implement administratively and are the hardest to evade: broad based consumption taxes. The progressives will then say: “oh yeah but they’re regressive - regressive in the sense the tax burden is highest on the lowest income and that’s true. But you can’t get stuck on that. What you’re concerned about is not the individual components of the fiscal policy - remember fiscal policy is spending and taxation - what you want is a progressive outcome over the whole mix. So just being obsessed with one component is not going to achieve a progressive outcome.

What you want is an efficient tax system that will create the real resource space that the government can spend into without causing inflation - that’s the role of taxes in modern monetary theory. And you want to do that in a way that is equitable and unavoidable. Then to solve the regressive characteristics of a broad based consumption tax, for example, you have to make sure your fiscal spending is highly progressive and that’s easy to achieve. You can target spending at low income areas of education, health, childcare, training.

If you focus on income taxes you know they’re avoidable by the top end of town.

Treasury bonds go brrrrrrr

Can you clarify the difference between QE ad the Reserve Bank buying bonds from Treasury? They both seem to get called printing money?

Look the term printing money should be expunged from the narrative. I never use it. It’s used as an ideological weapon against people who advocate government spending on welfare and helping the poor and disadvantaged and creating employment. And people who use the term know that it evokes images embedded into our psyche of Zimbabwe or the Weimar Republic. Wheelbarrows going to the bakery and mad public officials in basements running printers wild with money.

What QE is is a simple asset swap. The central bank says to government debt holders we will buy that debt off you and we’ll type some money into the bank system to facilitate that and those numbers go into bank accounts that show up as bank reserves. Reserve accounts are the accounts commercial banks hold with the Reserve Bank of New Zealand.

A lot of the people think that QE is helping the banks get more money to lend … so by providing them with more reserves they will loan them out and that will help fund investment and stimulate the economy. What they don’t understand is banking doesn’t operate like that at all. Banks don’t lend out reserves. The reserve accounts are there just as part of what we call the clearing system - the payment system So every day all sorts of transactions across banks are coming in and they have to be resolved and they’re resolved in through these reserve accounts: debits and credits for banks and that’s what these reserves account are. Banks don’t need reserves. In a modern banking system loans create deposits.

Banks are waiting for credit worthy borrowers to come through the door and then they’ll type a number into an accounting system and that will create a loan and immediately a source of liquidity a deposit.

The central banks are competing for bonds in the secondary bond market where bonds are bought and sold. They’re pushing up the demand for bonds and driving down the interest rate on them hoping that will stimulate investment in productive investment…. The flaw is that when times are very bad not many people want to borrow no matter how low the interest rates are.

When the government is spending it spends by the Treasury Department instructing the Reserve Bank to type numbers into bank accounts on its behalf. For procurement contracts for pensions and what have you. Numbers are just getting typed into bank accounts. No printing going on.

Now whether they match that with debt issuance or whether it reflects the expectation of tax receipts it doesn’t matter at all. They’re just typing numbers in every day.

So when they’re issuing or buying bonds so they can pay for this stuff they’re just unnecessarily committing themselves to paying an interest rate - it’s completely unnecessary?

The debt doesn’t fund the spending. The spending is funding by the fingers typing the numbers into the bank accounts.

So in effect are we just transferring wealth to the commercial banks and finance houses?

The practice of issuing government debt to match the deficits of spending above taxes is a legacy of the Bretton Woods system - the fixed exchange rate, gold standard system.

It was necessary then because the governments had to be very careful about the amount of liquidity in the system because the central banks were committed to maintaining their exchange rates at fixed parities. If there were too many NZ dollars in the system then the exchange rate would start to fall below the agreed parity and somehow you had to withdraw that. So they had to be very cautious when they spent dollars into the economy to make sure that that didn’t make excess dollars. That would drive the exchange rate down. So debt was a very effective tool to drain dollars.

Now in this freely floating exchange rate that practice is unnecessary. So why do governments continue to do that? Well because of corporate welfare. The debt is corporate welfare. It provides the speculative investment community with a risk free asset which they can use to speculate. And that was demonstrated very clearly in Australia towards the end of last century. The Australian government had been running surpluses and not re-issuing debt when it matured and by the end of the century the bond markets were very thin. So what does that mean? There wasn’t many debt instruments to be traded and speculated with. Who complained about that? The big investment banks. The Sydney investment exchange. They said we have to have a minimum amount of debt. Why? Because we use it to price all of our other risky assets and we use it as a vehicle to shift funds when times are uncertain.

The Australian government agreed - even though it kept running surpluses - so all the mainstream explanations for issuing the debt were void - they agreed they would continue to issue debt to satisfy the demand for a risk free asset to the speculative community. It’s corporate welfare.

If the money supply increased by, say, 30 percent to pay for all the jobs required wouldn’t that logically mean our currency was worth something like 30 percent less compared to other currencies?

The value of the currency has no relation to the fiscal position that the government takes. Historically you can’t find any robust statistical relationship and when Australia for example Australian dollar plunged to 49 cents US in the late ‘90s it was when the government was running the largest surpluses.

There is no relationship. What the foreign exchange community wants and what determines capital inflow and a demand for a currency is rule of law. They want to know that contracts are going to be enforceable and they’re not going to be investing money and have government take it off them, they want skilled labour and investment opportunities and they want stable government. All of which New Zealand has and is very attractive to the global community. They don’t care less whether your government running deficits. They prefer full employment. Recently I’ve been doing workshops for some of the very large investment banks and pension funds and what they’re telling me is the fiscal austerity era has undermined their business model because they’re used to being able to leverage off large scale infrastructure projects. So if the NZ government has some very nice green infrastructure projects that create good quality employment and good wages and provide investment opportunities for the investment community your currency won’t suffer at all.

So what determines how much foreign currency we can spend. What are the limits on that?

The ability for a country to run a trade deficit is dependent upon the desire of the rest of the world to accumulate financial claims in your currency. So Australia has run a fairly large external deficit of 3 or 4 percent mostly and that’s allowed us to enjoy massive material prosperity. And that’s because assets held in Australian dollars are seen as desirable because we have a stable government, we have a highly educated workforce, we have contractual certainty and rule of law: same as New Zealand.

So it only becomes a problem if you borrow in someone else’s currency?

A currency issuing government like New Zealand should never issue liabilities in a foreign currency. That’s what the problem of Argentina was. There’s no need to do that. And of course the global financial community and the IMF are always trying to push foreign currency loans on disadvantaged governments. But that’s the last thing they should ever do. It’s tying you to chaos and future disaster because then you have to generate export revenue in that foreign currency and soon as export markets take a diver, for whatever reason, nothing to do with your country and you run out of currency to service those foreign currency loans you’re cooked.

Ehnts

返信削除on JGP

https://d1wqtxts1xzle7.cloudfront.net/61704197/20605-Article_Text-42889-1-10-2019123120200107-53697-1flzd3t.pdf?1578403604=&response-content-disposition=attachment%3B+filename%3DThe_Job_Guarantee_Full_Employment_Price.pdf&Expires=1592182058&Signature=XLIVaH80gfySdFLMgpVIT7VKDECv3JK0R4SJxVlLWgy~G6~neuyN29MRBNAeLSNyhPHgNeX~lmUoGF8vqAnIKR0JQKW~T0f9DSa8VsXXNyxzwdWU1Bx-qDkG97XNEGtKVE9TNj~VlQlQUx0AjolJzN9uiNZkzbz7CYHqont2zGTHkFpAPq3fK8RGtZ~7OrvmqyloMdSGXw0wyLN-DPnMnNL3XqLaTU5gJMd77hLsvCw49OyGFQyH1j2KRaUJkTbDjB4HJKuQEnoORwf9IoxfOQ-8~PovV6der0uqLoER46p2uup6-olBILIiO~rIPsrWkypQRNqivvnA58l8uuKFcQ__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA

返信削除From your Reading History:

Steve Keen: Can we avoid another financial crisis?

Paper Thumbnail

Author Photo Dirk H Ehnts

500 Views

View PDF ▸

Download PDF

2. William S. Vickrey, Full Employment and Price Stability: The Macroeconomic Vision of William S. Vickrey, edited by Mathew Forstater and Pavlina R. Tcherneva, Edward Elgar, 2004.

返信削除https://www.amazon.co.jp/Full-Employment-Price-Stability-Macroeconomic/dp/1843764091

https://www.e-elgar.com/shop/usd/full-employment-and-price-stability-9781843764090.html

Contents:

Preface by David Colander

Introduction

1. Budget-Smudget: Why Balance What, How and When?

2. The Need for a Direct Anti-Inflation Program

3. Design of a Market Anti-Inflation Program

4. Meaningfully Defining Deficits and Debt

5. Chock-Full Employment without Increased Inflation: A Proposal for Marketable Markup Warrants

6. An Updated Agenda for Progressive Taxation

7. Today’s Task for Economists

8. My Innovative Failures in Economics

9. The Other Side of the Coin

10. Necessary and Optimum Government Debt

11. Why Not Chock-Full Employment?

12. A Trans-Keynesian Manifesto

13. Fifteen Fatal Fallacies of Financial Fundamentalism: A Disquisition on Demand Side Economics

14. We Need a Bigger ‘Deficit’

Epilogue by James K. Galbraith

Index

Introduction

返信削除It is not because things are difficult that we do not dare, it is because we do not dare that they are difficult. –Seneca

1 A Public Option for Good Jobs

2 A Steep Price for a Broken Status Quo

3 The Job Guarantee: A New Social Contract and Macroeconomic Model

4 But How Will You Pay for It?

5 What, Where, and How: Jobs, Design, and Implementation

6 The Job Guarantee, the Green New Deal, and Beyond

返信削除Preface

Introduction

(It is not because things are difficult that we do not dare, it is because we do not dare that they are difficult. –Seneca)

1 A Public Option for Good Jobs

2 A Steep Price for a Broken Status Quo

3 The Job Guarantee: A New Social Contract and Macroeconomic Model

4 But How Will You Pay for It?

5 What, Where, and How: Jobs, Design, and Implementation

6 The Job Guarantee, the Green New Deal, and Beyond

Index

https://www.amazon.co.jp/Case-Job-Guarantee-English-ebook/dp/B089RS8QTV/

返信削除2020/06/05

序文

前書き

(そうではない

あえてしないことは難しいので

それは私たちが難しいことを敢えてしないからです。 –セネカ)

1良い仕事のための公共オプション

2壊れた現状のための高価格

3仕事の保証:新しい社会契約とマクロ経済モデル

4しかし、どのようにそれを支払うのですか?

5何を、どこで、どのように:ジョブ、設計、実装

6仕事の保証、グリーンニューディール、そしてその先

インデックス

ここに明記されているグリーンな雇用保証のビジョンは、雇用創出と環境保全を結びつけています。また、グリーンポリシーは、特に私たちの人材を含め、あらゆる形態の廃棄物と荒廃に対処するものとして定義されています。グリーン政策は、特に経済的苦痛、失業、不安定労働に伴う怠慢と浪費を是正しなければならない。ノーベル賞受賞後期のエコノミスト、ウィリアムヴィックレイが主張したように、失業は「破壊行為と同等かそれ以上」であり、個人、家族、地域社会に良識のない犠牲と破滅をもたらします。 2しかし、従来の知識では、失業は「正常」であると考えています。エコノミストはそれを「自然」とさえ呼び、失業の「最適な」レベルを中心に政策を考案しています。

ここに明記されているグリーン雇用保証のビジョンは、雇用の創出と環境保全を結びつけるものです。それはまた、グリーン政策を、私たちの人的資源を含む、そして特に私たちの人的資源のものを含む、あらゆる形態の浪費と荒廃に対処するものとして定義します。緑の政策は、特に経済的な苦境、失業、および不安定な仕事と一緒に来る無視および浪費を改善しなければなりませません。故ノーベル賞を受賞した経済学者ウィリアム・ヴィックレイが論じたように、失業は「せいぜい破壊行為に等しい」ものであり、個人、家族、地域社会に理不尽な通行料と破滅をもたらす2。 2しかし、従来の常識では、失業は「正常」であると考えられています。経済学者はそれを「自然」と呼び、失業率の「最適」レベルを中心に政策を考案している。

2.ウィリアムS.ヴィックリー、完全雇用と価格の安定性:マシューフォースタターとパヴリナR.チェルネヴァが編集したウィリアムS.ヴィックリーのマクロ経済ビジョン、エドワードエルガー、2004年。

https://www.amazon.co.jp/Full-Employment-Price-Stability-Macroeconomic/dp/1843764091

kelton

返信削除today. Meanwhile, as Fadhel Kaboub recommends, South-South trade partnerships could help developing countries grow complementary industries and escape their current position in the global production chain, where they’re stuck importing high-value finished goods and exporting cheaper intermediate goods. Otherwise, we will need a system that transfers these productive resources and technological know-how from the developed world to the developing one. 39 That would deliver poorer parts of the world the industrial capacity they need to build up their (renewable) energy and (sustainable) food sovereignty—and thus escape the trap we discussed earlier of being dependent on imports to access critical resources. In theory and practice, lack of food and energy sovereignty are solvable problems. Even major food importing countries with mostly desert climates can adopt a sustainable agriculture program by investing in more water efficient hydroponic and aquaponics food production. And even countries with no oil or natural gas reserves can adopt a renewable energy program by installing solar and wind farms, and by investing in energy efficiency for housing and transportation. And to the extent that we encourage a global effort to contain the effects of climate change, policies that help the developing world to decarbonize their economies not only lessens their dependency on US dollars to purchase fossil fuels, but also enhances global cooperative efforts to reduce harmful carbon emissions that continue to threaten our planet’s long-term survival. As long as most developing countries have to import basic necessities, they will remain “developing”—caught in a desperate scramble to acquire the currencies of the rich world. Corporations around the world will keep feverishly chasing short-term profits, extracting scarce natural resources, polluting precious ecosystems, and ruthlessly firing desperate people, all in the name of maximizing shareholder value. Left unchecked, the situation is an open invitation for demagogues like Trump to come

kelton#5

返信削除一方、Fadhel Kaboubが推奨するように、南南貿易パートナーシップは、発展途上国が補完的な産業を成長させ、高価値の完成品の輸入とより安価な中間財の輸出で立ち往生しているグローバルな生産チェーンにおける現在の地位を脱するのを助ける可能性があります。さもなければ、これらの生産的資源と技術的ノウハウを先進国から発展途上国に移転するシステムが必要になります。 39これは、世界のより貧しい地域に(再生可能)エネルギーと(持続可能)食糧主権を構築するために必要な産業能力を提供し、重要な資源へのアクセスを輸入に依存するという先に述べた罠から逃れることができます。理論と実践では、食料とエネルギーの主権の欠如は解決可能な問題です。ほとんどが砂漠気候の主要な食品輸入国でさえ、より水効率の高い水耕栽培および水耕栽培の食料生産に投資することにより、持続可能な農業プログラムを採用できます。また、石油や天然ガスの埋蔵量がない国でも、太陽光発電所や風力発電所を設置し、住宅や交通機関のエネルギー効率に投資することで、再生可能エネルギープログラムを採用できます。そして、気候変動の影響を抑えるための世界的な取り組みを奨励する範囲で、途上国が経済を脱炭素化するのを助ける政策は、化石燃料を購入するための米ドルへの依存を減らすだけでなく、有害なものを減らすための世界的な協力の取り組みを強化します地球の長期的な生存を脅かし続ける炭素排出。ほとんどの開発途上国が基本的な必需品を輸入しなければならない限り、豊かな世界の通貨を獲得するために必死の争いに巻き込まれて、それらは「発展途上」のままであり続けるでしょう。世界中の企業は熱心に短期的な利益を追い求め、希少な天然資源を抽出し、貴重な生態系を汚染し、そして絶望的な人々を冷酷に駆り立て、すべて株主価値の最大化を目指します。チェックされずに残された状況は、トランプのようなデマゴーグが開かれるためのオープンな招待状です

kelton#7

返信削除vulnerable and the marginalized who, in many cases, have been excluded from socioeconomic progress,” as former United Nations secretary-general Ban Ki-moon noted. Here in America, low-income African Americans endured the most hardships and losses when Hurricane Katrina hit New Orleans in 2005, and they had the hardest time recovering. 60 Of course, global warming may not destroy human civilization. But the most likely business-as-usual scenarios do suggest global poverty reduction could be set back decades, which intrinsically means hundreds of millions of additional deaths. 61 But then, that’s assuming the consensus of the IPCC reports isn’t significantly underestimating the danger. 62 These are only the most likely scenarios; we may be underestimating the cascade effects and feedback loops, meaning there’s a small but real chance that business as usual will lead to far more catastrophic results. “We’re already at 1 degree warming and seeing some significant impacts,” Hultman wrote, summing up the IPCC’s conclusions. “1.5 degrees is going to have more severe impacts; 2 degrees has more; and we probably don’t want to test what happens above 2 degrees—although our current momentum appears to have us on a trajectory for about a 3 degrees or more world.” To hit the 1.5 degree target, the world will need to cut its fossil fuel use in half by 2030 and eliminate all fossil fuel consumption by 2050.63 Stated bluntly, this will require a total overhaul of US and global civilization. The way we practice agriculture and use land, the way we generate energy, the way we design our cities and transit—all will require extensive changes. We will need to drastically increase the efficiency with which our homes, buildings, factories, transportation systems, and everything else use energy, which will require a sweeping deployment of the latest technologies, both here in America and abroad. On top of that, we’ll have to completely revamp our national infrastructure to improve climate resilience and to electrify all forms of energy use, from cars to home heating to heavy industry. We’ll also need a massive build-out of solar, wind, storage, and other investments, so that all of our electricity comes from renewables—done as fast as possible. 64 The United States also bears special responsibility in this regard: we’re the world’s second-largest producer of greenhouse gas emissions—at 15 percent to China’s 25 percent—while America’s per-person emissions are more than double China’s. This sweeping renewal of American society is possible. The IPCC and other scientists conclude both the changes needed here in the US and globally can be accomplished more or less with technology already available. Again, if we realize the limit is real resources, not money or the “burden” of the national deficit, we can see that closing the climate deficit is possible if we act fast. Furthermore, all the work needed to close the climate deficit will help close the good jobs deficit, and efforts to shore up our communities and cities against the ravages of climate change would be part and parcel of closing the infrastructure deficit. The Mercator Research Institute on Global Commons and Climate Change (MCC) runs a carbon clock, counting down the days until humanity has emitted all the greenhouse gases it can afford and still stay under 2 degrees of warming. 65 It’s similar to the

元国連事務総長の潘基文氏が指摘したように、多くの場合、社会経済的進歩から除外されている、脆弱で取り残された人々。ここアメリカでは、2005年にハリケーンカトリーナがニューオーリンズを襲ったとき、低所得のアフリカ系アメリカ人が最も困難と損失に耐え、回復に最も苦労しました。 60もちろん、地球温暖化は人間の文明を破壊することはできません。しかし、最もありそうなビジネスとしてのシナリオは、世界の貧困削減が数十年前に戻される可能性があることを示唆しています。これは本質的に数億の追加の死を意味します。 61しかし、それはIPCCレポートのコンセンサスが危険を大幅に過小評価していないことを前提としています。 62これらは最も可能性の高いシナリオにすぎません。カスケード効果とフィードバックループを過小評価している可能性があります。つまり、いつものようにビジネスがはるかに破滅的な結果をもたらす可能性は小さいですが、実際の可能性があります。 「すでに1度の温暖化があり、いくつかの大きな影響が出ている」とIPCCの結論をまとめたハルトマンは書いた。 「1.5度はより深刻な影響を与えるでしょう。 2度はもっとあります;また、現在の勢いで3度以上の世界の軌道に乗っているように見えますが、2度を超えるとどうなるかをテストしたくないと思います。」 1.5度の目標を達成するには、世界は化石燃料の使用を2030年までに半分に削減し、すべての化石燃料消費を2050.63まで削減する必要があります。端的に言えば、米国と世界の文明の全面的な見直しが必要になります。私たちが農業を実践し、土地を利用する方法、エネルギーを生成する方法、都市や交通機関を設計する方法-すべてに大幅な変更が必要になります。私たちの家、建物、工場、交通システム、その他すべてがエネルギーを使用する効率を大幅に向上させる必要があります。これには、ここアメリカと海外の両方で最新のテクノロジーを徹底的に展開する必要があります。その上で、気候変動への耐性を向上させ、自動車から住宅暖房、重工業まで、あらゆる形態のエネルギー使用を電化するために、国のインフラを完全に刷新する必要があります。また、太陽光、風力、貯蔵、その他の投資を大規模に増強する必要もあります。これにより、すべての電力が再生可能エネルギーから供給され、可能な限り迅速に行われます。 64米国もこの点で特別な責任を負っています。米国の1人あたりの排出量は中国の2倍を超えていますが、私たちは世界第2位の温室効果ガス排出量の生産者であり、15%から中国の25%です。アメリカ社会のこの抜本的な更新は可能です。 IPCCと他の科学者たちは、ここ米国で必要な変化と世界的に変化の両方が、すでに利用可能な技術で多かれ少なかれ達成できると結論付けています。繰り返しになりますが、制限がお金や国の赤字の「負担」ではなく、実際のリソースであることを認識した場合、迅速に行動すれば気候赤字の解消が可能であることがわかります。さらに、気候赤字を解消するために必要なすべての作業は、良い仕事の赤字を解消するのに役立ちます。気候変動の被害からコミュニティや都市を強化する取り組みは、インフラストラクチャの赤字を解消するための一部です。グローバルコモンズと気候変動に関するメルカトル研究所(MCC)は炭素時計を実行し、人類が提供できるすべての温室効果ガスを放出し、それでも2度の温暖化にとどまるまでの日数をカウントダウンします。 65それはに似ています

返信削除US National Debt Clock mounted in New York City, displaying the historical record of prior deficit spending. 66 But unlike the National Debt Clock, the MCC’s carbon clock is tracking a deficit that actually matters. As of this writing, and at current rates of emission, we have a little less than twenty-six years to solve our climate deficit. The Democracy Deficit You might think there couldn’t possibly be any deficit more consequential than the fate of the global climate that sustains human civilization. But there’s one more gap in American life that, while not necessarily greater in scope, cuts even deeper because this deficit is the reason for all our other deficits. It’s why we perpetually fail to generate enough good jobs; why so many of us go without adequate health care or education; why we’ve pushed our planetary ecology to the brink of collapse, all seemingly without care. It’s the deficit between the few and the many; between the powerful and the powerless; between those with voice and those without. It’s our democracy deficit. As much as democracy rests on rights and values and constitutions, the democracy deficit begins, once more, with resources—with who has money and wealth and influence and leverage and who does not. Remember that MMT says the government deficit is always someone else’s surplus. And in the US in recent decades, as the government deficit has increased, dollars have flowed disproportionately into the pockets of the wealthy, creating vast distances between them and the rest of America. Such economic inequality is hardly new to America, but in recent years, it’s risen to heights not seen since the Gilded Age and the robber barons. Consider the Gini coefficient, a measure of income inequality that economists often rely on. A Gini coefficient of zero would mean a perfectly egalitarian economy, while a coefficient of one means that one person literally gets all the income generated. No country experiences either extreme. But the World Economic Forum reports that, among the advanced and long-term developed countries, none has a higher Gini coefficient than the United States. And our rapidly expanding disparities show no signs of abatement. 67 Yet many might ask, what’s the problem? The US economy seems to be doing well by any number of other measures. Isn’t inequality just the way of the world? Isn’t it a natural outgrowth of the dynamism and creative power in our land of opportunity? Doesn’t the lure of princely sums spur people to heights of creativity and achievement, benefiting us all in the process? In short, does inequality really matter? Yes, it does. The economic realm is not separable from the social realm and the political realm. Income and wealth are both measures of the political power and social clout human beings possess—if the first is unequally distributed, the second is unequally distributed as well. Income provides people material essentials, but decent pay and decent hours also give people time and stability to participate in family and community. A well-known

返信削除過去の赤字支出の歴史的記録を示す、ニューヨーク市に設置された米国国債時計。 66しかし、National Debt Clockとは異なり、MCCの炭素時計は実際に重要な赤字を追跡しています。これを書いている時点で、現在の排出率では、気候赤字を解決するのに26年弱かかります。民主主義の赤字人間の文明を維持する地球規模の気候の運命ほど重大な赤字はあり得ないと思うかもしれません。しかし、アメリカの生活にはもう1つのギャップがあり、必ずしもその範囲は広いとは限りませんが、この赤字が他のすべての赤字の理由であるため、さらに深くなります。それが、私たちが十分に良い仕事を生み出すことに常に失敗している理由です。私たちの多くが適切な医療や教育を受けられない理由。なぜ私たちが惑星の生態学を崩壊の瀬戸際に追いやったのか、すべて一見無関心だったようです。それは少数と多数の間の赤字です。強力なものと無力なものの間。声のある人と声のない人の間で。それは私たちの民主主義の赤字です。民主主義は権利と価値観、憲法に依存しているのと同じように、民主主義の赤字は、資金と富と影響力と力を持っている人と持っていない人からリソースで始まります。 MMTは、政府の赤字は常に誰かの余剰であると言っていることを忘れないでください。また、ここ数十年の米国では、政府の財政赤字が増加したため、ドルが富裕層のポケットに偏って流入し、裕福な人々と他のアメリカ諸国との間に大きな距離が生まれました。そのような経済的不平等はアメリカにとってほとんど新しいものではありませんが、近年では、ギルデッド時代と強盗男爵以来見られないほどの高さにまで上昇しています。経済学者がしばしば依存する所得の不平等の尺度であるジニ係数を考えてみましょう。ゼロのジニ係数は完全に平等主義の経済を意味し、一方係数1は一人が文字通りすべての収入を得るということを意味します。どちらの国でも極端な経験はありません。しかし、世界経済フォーラムは、先進国および長期の先進国の中で、米国よりも高いジニ係数を持っている国はないと報告しています。そして、急速に拡大する格差は緩和の兆候を示していません。 67しかし、多くの人が尋ねるかもしれませんが、何が問題なのですか?米国経済は、他のいくつかの措置によって好調に推移しているようです。不平等は世界のあり方ではありませんか?それは、私たちの機会の土地におけるダイナミズムと創造力の自然な結果ではないでしょうか?プリンスリーサムの魅力は人々を創造性と達成の極みに駆り立て、その過程で私たち全員に利益をもたらしませんか?要するに、不平等は本当に重要なのでしょうか?はい、そうです。経済の領域は、社会の領域や政治の領域から切り離せません。収入と富はどちらも、人間が所有する政治的権力と社会的影響力の尺度です。1つ目が不均等に分配されている場合、2つ目も不均等に分配されています。収入は人々に重要な必需品を提供しますが、まともな賃金とまともな時間は、人々に家族とコミュニティに参加する時間と安定性も与えます。よく知られている

返信削除BIという水を入れる前にJGPで穴を塞ぐ

返信削除あるいは弾力を持たせる

失業者を大量に抱えたままインフレになるよりはマシです。

返信削除本質的にはGNDが必要になるでしょう。

BI論者がJGPを必要以上に批判するのは敵を間違えていると思います。

返信削除ココ・ファーム・ワイナリー [いいね!JAPAN ソーシャルアワード]「風に吹かれる係」

https://youtu.be/hfUsQNUWznc?t=3m40s

返信削除ゴミ掃除も医者も警官も軍隊も仕事が無い方がありがたい。

平和の証だから。

そうまるといざという時の為の自己鍛錬が仕事になる。

自衛隊などその典型。

ここで義務教育と完全雇用が接続する。

義務教育に疑問を持たない人間が完全雇用に拒否感を持つのは滑稽だ。

ちなみに東京都は以下の試みをしているが既存の企業のノウハウ活用は当然だ。

職場体験実習 | TOKYOはたらくネット

https://www.hataraku.metro.tokyo.lg.jp/young/shugyo/index.html

例えば最近の生き残っている地方の建設業はニートを一人前にするノウハウを持つ。

即戦力が欲しければ職業教育を見直す機会と考えるべきだ。

(全員がプログラマーになる必要はないが、論理学として教えるなら有益)

そもそも日本にはマイスターの概念が足りない。

ココ・ファーム・ワイナリー [いいね!JAPAN ソーシャルアワード]「風に吹かれる係」

https://youtu.be/hfUsQNUWznc?t=3m40s

GNDのなかでなら誰でも仕事がある

110 金持ち名無しさん、貧乏名無しさん (ワッチョイ c724-t6zs)[sage] 2020/01/26(日) 06:55:45.79 ID:ZUETUQS70

返信削除https://video.twimg.com/ext_tw_video/1194572707184070656/pu/vid/1280x720/VHIuz0sfocHgyxvb.mp4

OK、フィル・ハーヴェイは失業を骨の話で説明しています

部屋に95本の骨を入れてから、骨を得させるために100匹の犬を送ります。

5匹の犬は骨を取得しません

経済学者と社会学者は5匹の犬を脇に連れて行きます。

特別な訓練コースを受けさせ

確実に骨を得る技能を身につけさせる

そしてまた実験をする

彼らは骨を取得させるために100匹の犬を送ります

これらの5匹の犬は今回、骨を持って戻ってきます。

彼らは一生懸命働けば誰でも骨を得られるという

別の5匹が今度は骨を得られない

失業率は5%、5匹は職を得られない

これをマクロの問題と呼びます

訓練によって解決するのはミクロの問題

マクロの問題をミクロのレベルで解決出来ません

唯一の解決策は5本の骨を与えることです

Warren Mosler MMT: Unemployment, dogs and bones.

https://youtu.be/2vTjLwYCi24

THE TALE OF100 DOGS AND 95 BONES

https://nam-students.blogspot.com/2019/11/the-tale-of100-dogs-and-95-bones.html

ヘッドホン(Suzuki Yuto) 2nd year of graduate studies (@bktmskman)

返信削除2020/09/17 21:24

MMTにとってJGPが付属物

もしそういうのであれば

貨幣の実質価値を担保し, 完全雇用と物価安定を図れるようなそんな措置がJGP以外にあるならば, それで良いですよ

(そんなものはないだろうというのがMMTerの姿勢です) twitter.com/RockofBuddhism…

https://twitter.com/bktmskman/status/1306569619545579526?s=21

http://twitter.com/TskLimited/status/1306491732121366535

返信削除MMT が BI に反対してんのは、金を直接配ると人間やる気を失うからだと思ってる。あと「お前らBI 貰ってんだから時給減らすな」と雇用者(資本家の言葉の方がいいですかね)が言いやすいとか。

一方、MMT の JG は貨幣じゃなくて労働の方に価値(人間の本質)を置いてるから出てくる発想な気がするね。

http://twitter.com/chocomon174/status/1306533323301203971

@TskLimited 金を直接配ると人間やる気を失うから

→生活保護も同じじゃね?

「お前らBI 貰ってんだから時給減らすな」と雇用者が言いやすい

→「労働時間減らせ」と労働者が言いやすい

JG は貨幣じゃなくて労働の方に価値(人間の本質)を置いてる

→BIは自由な時間を生み出す方に価値を置いてるとも言える

iPhoneから送信

http://twitter.com/RockofBuddhism/status/1306524458333528065

返信削除BIの否定についてはそうじゃないと思ってる。BIは完全雇用に近い状態だと確実にインフレを引き起こすから。JGPとの相性が良くないんですよ。

個人的には、いずれも理念的にはなんの対立もしないと考えているけど、政策としての相性が良くなさすぎる。てゆーかMMTの人、ホントBIの歴史学ぶ気ないよね。

かぼちゃたぬきhttp://twitter.com/Mvr1CyJB00xKQge/status/1306528472592822272

返信削除@RockofBuddhism JGPの政策目的が「生活所得の保証」なんで、BIの政策目的とかぶっちゃいません?

両方やる場合、BIですでに生活所得が保証されているなら、JGPの賃金はゼロでもいいような。

http://twitter.com/ferreenern/status/1306531058368868352

@RockofBuddhism テクニカルにも相容れませんが、そもそも理念的に相容れないんですよ。

少しは勉強して下さい。

「BIの歴史学ぶ気ないよね」などと放言するほど驕り果てるなら義務でしょう。

返信削除https://www.cbc.ca/amp/1.5664199?__vfz=medium%3Dsharebar&__twitter_impression=true

Job guarantee program could bolster economy more than basic income, says author

CBC News

'Folks who receive basic income report that they still need work'

Posted: July 27, 2020

Stock Unemployment Rate Photo

'We really need a transitional program, we need some sort of guarantee that folks that are searching for work can find it,' says professor and author Pavlina Tcherneva. (David Ryder/Bloomberg)

While an all-party committee on poverty is reviewing what a basic income guarantee could look like on P.E.I., a suggestion by a Charlottetown social justice group is going one step further with a job guarantee program.

A member of the MacKillop Centre for Social Justice pitched members of P.E.I.'s special committee on poverty on the idea that a job guarantee program would do more than a basic income guarantee to combat the root causes of poverty.

Pavlina Tcherneva is an associate professor of economics at Bard College in New York, who recently published a book titled, The Case for a Job Guarantee.

ADVERTISEMENT

She says a job guarantee program is essentially an employment safety net — a federal employment program administered locally that provides basic job opportunities, with wages and benefits, to those seeking a job — that would be more beneficial than basic income.

Pavlina Tcherneva

Pavlina Tcherneva is an economist and associate professor, as well as the author of The Case for a Job Guarantee. (Pavlina Tcherneva/Twitter)

"In my view, the job guarantee is better, but it certainly coexists with some basic income for people who cannot work for one reason or another — but income alone doesn't create the job opportunities that are already missing," she said.

"We really need a transitional program, we need some sort of guarantee that folks that are searching for work can find it. And while basic income may be temporary assistance, folks who receive basic income report that they still need work, they are looking for work and they just cannot find it. So the job guarantee is that mechanism."

Pandemic didn't create job disparity but revealed it, council suggests

People who are out of work, for whatever reason, have a "terrible time" finding employment, Tcherneva said — and have a harder time finding work than someone already employed.

The economy goes through these cycles, ups and downs, and usually the collateral damage are people. — Pavlina Tcherneva, economist

"In fact, firms do not like to hire the unemployed, and then they slip into long-term unemployment, and they suffer enormous social and economic costs. So by comparison, the job guarantee will provide first employment opportunity, also the on-the-job training, as well as all of the other support services that unemployment offices provide," she said.

ADVERTISEMENT

"By comparison with being faced by mass unemployment, having a job is actually really better from the point of view of the employer, but also the program itself will help with placement."

Basic income guarantee can be reality on P.E.I., says poverty committee chair

返信削除'Automatic stabilizer'

A federally-funded job program also serves to stabilize the economy, Tcherneva argued, ensuring people are able to continue to earn money and, therefore, spend money.

"As we are acutely aware, the economy goes through these cycles, ups and downs, and usually the collateral damage are people — they lose their jobs," she said.

We have found occasions in our historical past where we know the government can guarantee employment. — Pavlina Tcherneva, economist

"It's that very expenditure that will provide the stimulus to the economy to kick-start private sector activity and employment. As that recovers, then people transition back into private sector jobs, and the public role shrinks, so it is an automatic stabilizer."

Tcherneva said there is often opposition to a job guarantee program, which she believes stems from an ideological bias, but some of the scrutiny that kind of proposal would face may be minimized, given the economic realities created by the COVID-19 pandemic.

ADVERTISEMENT

"I think also there is this tacit assumption that somehow unemployment is unavoidable and that perhaps unemployment is even necessary to stabilize the economy … I think that we really need to question these very deeply," she said.

"We have found occasions in our historical past where we know the government can guarantee employment. Unfortunately, that has happened during wartime — but we certainly can do this for civilian purposes. I think it's just the shift of perspective and just realizing that the costs are there and we just can spend our resources in much more fruitful ways."

Meanwhile, P.E.I.'s special committee on poverty has asked for a five-month extension until November to decide whether to recommend a basic income guarantee for the province.

More from CBC P.E.I.

P.E.I. did 'fantastic job' on Dorian, but room for improvement: consultant

Islanders hit by pandemic gradually taking up power bill deferral offer

Lana Dell #MMT #RealProgressives (@organicfanatic5)

返信削除2020/09/18 4:51

This is outstanding stuff w/Prof @John_T_Harvey. Even if U don't understand every word, it's fascinating & another example of the progressive PHD economists - who R genuinely decent humans that want 2 make meaningful change 4 the average person. Plz see Cowboy Economist YouTube. twitter.com/ActivistMMT/st…

https://twitter.com/organicfanatic5/status/1306682298448990208?s=21

#01: How to tell if someone is a socialist!

返信削除https://youtu.be/1ts1L-tNOuQ

返信削除https://en.m.wikipedia.org/wiki/Phil_Harvey

Phil Harvey

For Coldplay's creative director, see Phil Harvey (manager).

Phil Harvey (born April 25, 1938) is an American entrepreneur, philanthropist and libertarian who has set up large-scale programs that deliver subsidized contraceptives in poor countries. Harvey is the founder and former president of DKT International, the Washington, D.C.-based charity that implements family planning and HIV/AIDS prevention programs in 57 countries across Africa, Asia and Latin America. He is the chief sponsor of the DKT Liberty Project which raises awareness about freedom of speech issues in the U.S. Harvey is also the president of Adam & Eve, the North Carolina–based company that sells sex toys, adult films and condoms. Consequently, he has been called "one of the most influential figures in the American sex industry today".[1]

Books

返信削除The Human Cost of Welfare: How the System Hurts the People It's Supposed to Help (2016) with Lisa Conyers - Drawing on research including interviews with men and women on welfare, this book shows how welfare programs keep people from working with crippling consequences not only for them but for our whole country.

Show Time (2012)[7] – Harvey's first novel is a psychological thriller that takes on reality shows.

Government Creep: What Government Is Doing That You Don't Know About (2003)[8] – Strip searches, confiscated homes, stolen children, denial of due process. Sounds like life in a Third World country, but this is our own federal government invading our personal lives, supposedly for our own good.

The Government vs. Erotica (2001)[9] – Harvey traces the various prosecutions of his company, Adam & Eve, which started as a mail-order supplier of condoms, then branched into the distribution of adult films and sexual paraphernalia.

Let Every Child Be Wanted: How Social Marketing is Revolutionizing Contraceptive Use Around the World (1999)[10] – This book provides the only comprehensive examination of contraceptive social marketing, documenting a form of international assistance that has attracted support from governments, foundations and other donors.

EXメス牛@2番草🚜◇= (@Houboku01)

返信削除2020/09/17 22:42

JGPの方は、お金を出すのは政府だけど仕事を提供するのは自治体やNPO、共同組合ってことになってて。

これらの中間組織のメンバーが意思を持って主体的に取り組めば、パソナを締め出すことはできるのでは…などと考えてる。

https://twitter.com/houboku01/status/1306589377397534720?s=21

rory / 仏教ロック! (@RockofBuddhism)

2020/09/19 10:03

すごく良い提案。こうしたその地域ごとの主体性に期待しているのがJGP。”自分たちにとって本当に必要な仕事”。ある意味では面倒だし、ある意味ではおせっかい。

これは推測だけど、JGの具体的な業務を挙げてしまうと主体性が失われただ与えられるだけのものに成り下がることをMMTerは危惧している。 twitter.com/Houboku01/stat…

https://twitter.com/rockofbuddhism/status/1307123004263010306?s=21

池戸氏らはAIがBIを可能にすると考えているがそのためにはかなり大規模な消費者運動が必要だと思う。

返信削除また労働者側によるワークシェアには労働者側の地位向上が必要で、JGPで最低賃金を規定することはその前段階で必要だと思う。

救貧法かそれともフリードマン的新自由主義か

BIの起源は後者だと思うが

救貧法起源ならば今ある生活保護を改訂して行く視点が欠かせないはず

Tweet from @ferreenern

返信削除ヨーロッパで500ユーロと言われたから7万円と言ってそれ以外何も言わないBI論者でたらめすぎん?

ま、アメリカで15ドルと言われたから1500円と言っているJG論者も全く同じなんですが

こっちは一応、日本の都市部の生活賃金は時給1700円ぐらい(15ドルだ)という調査が後からきてたまたま正当性ゲット

http://twitter.com/ferreenern/status/1309096337028321281

Sent from Echofon - http://www.echofon.com/

iPhoneから送信

586 金持ち名無しさん、貧乏名無しさん (ササクッテロ Sp79-GMsJ)[sage] 2020/11/06(金) 12:11:48.22 ID:cMGzHwobp

返信削除https://note.com/murashinn/n/n506134a9052a

JGPに対する、よくある質問

この記事では、2018年のパブリナ・チャーネバさんの論文「The Job Guarantee: Design, Jobs, and Implementation」

[ http://www.levyinstitute.org/pubs/wp_902.pdf ]の中にある「JGPに対するよくある質問」の

紹介をしていきます。

全部で50のQ&Aから構成されているため、ちょっと長くなりますがお付き合いください。

1. プログラムは何人を雇用するのか?

プログラムの雇用は、景気循環や民間企業の雇用動向によって変動する。ジョブギャランティ(JG)は、

非自発的に失業している人や、フルタイムの仕事がないためにパートタイムで働いている人の採用

が期待されている。

2017年12月、アメリカでは

- 失業者は660万人

- パートタイムで働いているがフルタイムの仕事を希望している490万人

- 働きたくても公式統計にカウントされなかった590万人。

つまり、安定した高給取りの仕事を

希望していたが、安定した仕事を見つけられなかった人が少なくとも1,680万人いることになる。

…

47. …

完全雇用への政治的障害は歴史的に依存している。様々な歴史的事例が示すように、克服できない

ものではないが、課題は相当なものかもしれない。

戦後何十年にもわたって、スカンジナビアのコーポラティズムモデルは、企業、組合、政府の間の

調整に基づいた社会契約によって長期的な完全雇用を確保し、政府は最後の手段の雇用者として

の役割を果たした(Ginsburg 1983)。日本の産業モデルと積極的な労働市場政策は、戦後数十年間、

失業率を2.5%以下に維持することに成功していた。いずれの場合も、完全雇用モデルは、レーガン/

サッチャー政権後の新自由主義政策の出現によって終焉を迎えた。しかし、途上国であるインドは

2005年に世界最大のJGPを実施した。この政策は、企業の利害関係者からの反対に直面しているが、

多くの支持を集め続けている。

589 金持ち名無しさん、貧乏名無しさん (ササクッテロ Sp79-GMsJ)[sage] 2020/11/06(金) 12:22:00.79 ID:cMGzHwobp

返信削除2020/09/17 22:42

JGPの方は、お金を出すのは政府だけど仕事を提供するのは自治体やNPO、共同組合って

ことになってて。

これらの中間組織のメンバーが意思を持って主体的に取り組めば、パソナを締め出すことは

できるのでは…などと考えてる。

https://twitter.com/houboku01/status/1306589377397534720?s=21

2020/09/19 10:03

すごく良い提案。こうしたその地域ごとの主体性に期待しているのがJGP。”自分たちにとって

本当に必要な仕事”。ある意味では面倒だし、ある意味ではおせっかい。

これは推測だけど、JGの具体的な業務を挙げてしまうと主体性が失われただ与えられるだけのもの

に成り下がることをMMTerは危惧している。

https://twitter.com/rockofbuddhism/status/1307123004263010306?s=21

https://twitter.com/5chan_nel (5ch newer account)

269 名無しさん@お腹いっぱい。[] 2020/11/09(月) 17:09:28.21 ID:mQeOoF6z

返信削除MMTには説明的な部分と規範的な部分があるとMMT現代貨幣理論入門に書いてある

説明的な部分は貨幣論

規範的な部分はJGP

てかJGPに関してはフリードマンが1948年の論文を根拠としてもできるだろ

https://www.jstor.org/stable/1810624

A Monetary and Fiscal Framework for Economic Stability(経済安定のための貨幣と財政の枠組み)

270 名無しさん@お腹いっぱい。[] 2020/11/09(月) 17:11:43.13 ID:mQeOoF6z

>>269

この論文の中でミルトンフリードマンも財政破綻に関する見解はMMTとほぼ一致してる

それにフリードマンは政府を信用してないないことで有名

だから「当局」よりも「規律」を支持した

こういった面もJGPと融合できると思う

274 名無しさん@お腹いっぱい。[] 2020/11/09(月) 17:44:27.44 ID:mQeOoF6z

>>271

なんか規制入ってURL貼れないが

福祉国家と機能的財政 ― ラーナーとレイの議論の考察を通じて―

岡本英男

ていうPDFの中にも

「ミル トン・フリードマンはまさに自由市場経済学の発展における,そしてインフレの危険から守 る経済政策の策定における中心人物として見なされている。しかし,フリードマンは 1948 年の論文の中で,政府支出はときどきフィアット・マネーでもってファイナンスされるべき だということのみならず,つねに債務ファイナンスが決して有用な役割を果たさないかたち でファイナンスされるべきだと主張している。」

と書かれてる

272 名無しさん@お腹いっぱい。[] 2020/11/09(月) 17:35:08.63 ID:mQeOoF6z

返信削除あとMMTは会計を中心に分析を行ってる学派

「要するに、オーソドックスな均衡アプローチを信奉する経済学者の連中は、危機(リーマンショック)を予見しなかったし、できるはずもなかった、というのがベセマーの結論である。それどころか、彼らは危機を生み出す一因となったあらゆる金融革新を軽視するか、もしくは、そうした革新はリスクを減らして金融システムの回復力を高めるものだとみなしていた。正しく理解していた十人余り(エリザベス女王の元に召集された経済学者)は、均衡の概念を捨て、代わりにストックとフトーが矛盾なく扱われるフロー循環アプローチを採用していた。彼らは、供給と需要の均衡よりもむしろ会計の恒等式を重視していた。また、金融システムを「実体」経済とは別のものとして明確にモデル化すると共に、最適化エージェントモデルは採用せず、むしろ不確実性を考慮していた。

この入門書は、ワイン・ゴットリーの先駆的研究を範として、会計の恒等式およびストックとフローの扱い方から始まってる。ゴットリーと私は、1990年代の持続不可能な「ゴルディロックス経済」に警笛を鳴らしてきた」(MMT現代貨幣理論入門 10-1)

505 名無しさん@お腹いっぱい。[] 2020/11/13(金) 21:51:10.83 ID:+cVTk0de

返信削除35. 旧ソ連にはJGPはなかったのか?それはあなたが提案していることではないのですか?

いいえ、JGPはそのようなものではない。第一に、JGは市場条件の中で機能し、民間部門の雇用を補完する役割を果たしている。民間の労働市場が強ければ強いほど、JGPの規模は小さくなる。旧ソ連圏では、政府が第一の雇用者として、唯一の頼みの綱として機能していた。対照的にJGPは最後の雇い手であり、連邦政府は通常、実際の雇用を行わない。

歴史的な例を見ると、大規模な雇用プログラムは短期間で開始でき、非常に効果的に実施できることが示されている。しかし、JGP を段階的に導入する方法の一つとして、まず若者 JGP を実施することが考えられる。若者のための直接雇用プログラムの良い結果を示す成功したプログラムは世界中に数多く存在している。そのような若者JGPは、最終的には合法的な労働年齢に達し、就労を希望するすべての人に拡大する役割を果たすことができる。

356 金持ち名無しさん、貧乏名無しさん (ワッチョイ 9bc9-QkVp)[sage] 2020/11/16(月) 22:04:25.66 ID:cIoYL4yY0

返信削除バイデン次期大統領の経済プラン、高成長演出で雇用回復を狙う

Matthew Boesler

2020年11月16日 13:08 JST

https://www.bloomberg.co.jp/news/articles/2020-11-16/QJUXLIDWLU6E01

失業者に必要なのは再訓練だという「技能ギャップ」説に疑念

連邦準備制度を含む当局者も需要喚起の必要性巡り認識深める

新型コロナウイルス禍の経済の落ち込みから、米国に完全雇用を取り戻すバイデン次期米大統領の計画の背後には、長らく忘れ

去られていたアイデアがある。それは、失業者に必要なのは新たな技能の習得ではなく、雇用そのものだという考えだ。

高成長を演出して経済回復を確実にするこのアプローチは今や、連邦準備制度も含む当局者の間で再び受け入れられている。

政府があらゆる手段を用いて経済を刺激し、人々の再雇用に十分なだけの力強い需要を喚起すべきだというのがその趣旨だ。

これは、近年のリセッション(景気後退)後に主流だった技能ギャップの考えとは対照的だ。再訓練で新たな技能を身に付けない

限り、職を失った米国人の多くは再雇用の見込みはないというのがこの主張の論旨だった。

357 金持ち名無しさん、貧乏名無しさん (ワッチョイ 9bc9-QkVp)[sage] 2020/11/16(月) 22:04:43.48 ID:cIoYL4yY0

>>356

米政府は既に新型コロナ禍を受けた計3兆ドル(約314兆円)の経済対策をまとめており、バイデン氏が政府支出のさらなる拡大

を意味するアプローチをどこまで推進することができるかは、来年1月にジョージア州で行われる上院議員選挙の決選投票の結果次

第となりそうだ。

民主党が同州で2議席とも確保できれば、一段の景気対策に加えてクリーンエネルギーや子育て支援への投資などのバイデン氏

のプランの実現につなげることができる一方、共和党が上院で過半数を維持すれば、一連のプランが妨げられる可能性がある。

オバマ前政権でバイデン氏のチーフエコノミストを務めた経歴を持ち、現在も顧問の1人であるジャレッド・バーンスタイン氏は「労働

者に十分な職がなければ、彼らがどんなに多くの技能を習得しようと意味がない。不完全雇用が続くことになる」と指摘した。

氏は、「歴史的に見ると、技能ギャップ説は政府や連邦準備制度の介入を促すのを避けるために利用されてきた」と述べた上で、

「基本的に、問題があるのは労働者であって経済ではないというこの議論は、何度も誤りであることが証明されてきた」と話した。

原題:Run-It-Hot Wins Argument Over How to Get Americans Back to Work(抜粋