Inflation and the Phillips Curve (A) Demand-Pull and Cost-Push Inflation

https://freeassociations2020.blogspot.com/2020/05/inflation-and-phillips-curve-demand.html

戦費調達論1940 How to Pay for the War John Maynard Keynes

https://link.springer.com/chapter/10.1007/978-1-349-59072-8_27

How Much Does Finance Matter ケインズ Keynes 1942

In the long run, we are all dead.

—JOHN MAYNARD KEYNES, December 1923

In the long run almost anything is possible.

—JOHN MAYNARD KEYNES, April 1942

参照:

英語版 Zachary D. Carter (著) 形式: Kindle版

How Much Does Finance Matter 1942

全集27巻所収

With that analysis in our minds, let us come back to the building and constructional plans. It is extremely difficult to predict accurately in advance the scale and pace on which they can be carried out. In the long run almost anything is possible. Therefore do not be afraid of large and bold schemes. Let our plans be big, significant, but not hasty. Rome was not built in a day. The building of the great architectural monuments of the past was carried out slowly, gradually, over many years, and they drew much of their virtue from being the fruit of slow cogitation ripening under the hand and before the eyes of the designer. The problem of pace can be determined rightly only in the light of the competing programmes in all other directions.

この分析を念頭において建築・建設計画に立ち返りましょう。計画を実行できる規模とスピードを、事前に正確に予測することはきわめて困難であります。しかし長期的には、ほとんどのことが可能です.それゆえ、大規模で大胆な計画を恐れてはなりません。われわれの計画を大きく、有意義なものにいたしましょう。しかしあせってはなりません。ローマは一日にして成らず、です。過去の偉大な記念碑的建造物は長い年月をかけて、ゆっくりと建設されましたし、それらは、設計者の掌中および眼前で、じっくりと練られた成果が熟成していくということから、その美点の多くを引き出しましたコ。スピードの問題は、他のすべての方面での競合する計画を考慮することによってのみ正しく決定することができます。

#27:306~7頁

John Maynard Keynes: How Much Does Finance Matter?

https://www.bradford-delong.com/2020/05/john-maynard-keynes-how-much-does-finance-matter.html

John Maynard Keynes: How Much Does Finance Matter?

#economics #economicsgoneright #macro #noted #2020-05-30

The right way to budget for a #GreenNewDeal is the way JM Keynes approached the question in his "How to Pay for the War." i.e. national resource planning. It wasn't about where to get the money. It was about how to manage the transition to a war economy.

— Stephanie Kelton (@StephanieKelton) December 3, 2018

| Libre Equity (@LibreEquity) |

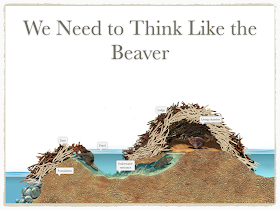

Stephanie Kelton @StephanieKelton: When asked how to pay for a #GreenNewDeal, think less like a banker, and more like a beaver via @payforgnd #LearnMMT #MMT #JobGuarantee pic.twitter.com/D0AXj93hSX | |

John Maynard Keynes: How Much Does Finance Matter? 1942

https://www.bradford-delong.com/2020/05/john-maynard-keynes-how-much-does-finance-matter.html ☆We Have to Think Like the Beaver

https://youtu.be/bn-DeJOfzKA

So let me start with an oversimplification.

The beaver simply does -- what? Goes out and: resources the materials.

This guy's an engineer. He's an architect.

He pulls the permits, right.

He's the code inspector. He does it all!

He goes out there and he says: “I'm gonna take this tree down.

I want us instead of allowing people to drag us into a “pay-for” fight that is about financial resources --

[you're at] “What you're really asking when you say ‘how are you gonna pay for it’ --

you're really asking me to tell you how I'm gonna resource this.”

https://www.economicpolicyresearch.org/images/docs/research/climate_change/CC_Green_New_Deal_event/Kelton_New_Deal_presentation.pdf

It's About Our Real Constraints

HOW TO PAY

FOR THE

Stephanie Kelton

The right way to budget for a

#GreenNewDeal is the way JM Keynes

approached the question in his "How to

Pay for the War." i.e. national resource

planning. It wasn't about where to get

the money. It was about how to manage

the transition to a war economy.

https://twitter.com/stephaniekelton/status/1069597640508231680?s=21

ケインズのマグカップ

https://love-and-theft-2014.blogspot.com/2021/01/the-deficit-myth-and-price-of-peace-c.html?m=1

同趣旨のケインズ論考:

Keynes

How Much Does Finance Matter 1942

全集27巻所収

多分MMT的には最も重要なケインズのテキストのひとつ

I am sure there have been many listeners who have been muttering :

‘That's all very well, but how is it to be paid for?' (KOW216)

Keynes said, “Anything we can actually do we can afford.” And “once done, it is there.”

参考:

財政出動における真水とは?

https://freeassociations2020.blogspot.com/2020/05/blog-post_33.html

MMT関連書籍

https://nam-students.blogspot.com/2019/11/mmt_30.html

https://freeassociations2020.blogspot.com/2020/05/how-much-does-finance-matter-keynes-1942.html

https://iitomo2010.blogspot.com/2020/05/keynes1942.html★

| Stephanie Kelton (@StephanieKelton) |

Extremely good piece from @CoreyRobin newyorker.com/culture/cultur… | |

Fiscal fallacies (1): Keynes wanted ‘Government loan-expenditures’, NOT deficit spending Geoff Tily

Fiscal fallacies (1): Keynes wanted ‘Government loan-expenditures’, NOT deficit spending

KOW, Keynes on the Wireless, a collection of his radio addressed published in 2010 (Palgrave Macmillan)

https://www.amazon.co.jp/Keynes-Wireless-D-Moggridge/dp/0230239161/★★★

MTP, The Means to Prosperity, combined four newspaper articles in a 1933 pamphlet, and is reprinted in modern editions of his Essays in Persuasion, most recently in 2010 (Palgrave again).

★★★

ケインズ関連動画:メモ の Keynes on the Wireless : John Maynard Keynes(Donald Moggridge 編 Palgrave Macmillan 社刊 2010年) 神 藤 浩 明 https://jww.iss.u-tokyo.ac.jp/jss/pdf/jss630304_137144.pdf

1942 年春までに,Keynes と大蔵省の同僚,戦時内閣府経済部の経済学者たちは戦後の世界秩序の構築に向けた議論に関わっていたが,HowMuchDoesFinanceMatter?(1942 年3月23日放送)は BBC のトークシリーズ‘Post-WarPlanning’ の一部を成すものである.Keynes は今回の戦争終結時における財政の技術的問題は,平和時に良好な雇用情勢が維持される限り,また今日有用で不可欠である金融機構に対する規制の多くが維持される限り,第一次世界大戦後の終結時ほど困難ではないとみていた.その上で,国民にあまねく雇用を提供 できる十分な需要を確保すること,物理的に可能な供給を上回る需要をつくりださないこと,戦後直後は輸出産業の再興に注力すべきこと,その後の余剰資源と労働力が capitalworksof improvementに利用可能となるであろうことを説いた.そのためには,我々が必要とする幅広い分野を網羅した復興プログラムを準備することが必要であり,その実行の速度については様々な種類の競合するプロジェクトの優先順位に依存することになるという.‘Rome was not built in a day.’ という諺を引き合いに出した背景には,戦後復興はあくまで長期的なプログラムに沿って進めることが重要であり,速さを強要してはならず,各種プログラムを適切な速さに制御して実行に移すことこそが政府の重要な任務だという Keynes の想いが色濃く反映されていることを忘れてはならないだろう.

全集27

The Pandemic Is the Time to Resurrect the Public University By Corey RobinMay 7, 2020

Stephanie Kelton (@StephanieKelton)

2020/05/07 23:12

Extremely good piece from @CoreyRobin newyorker.com/culture/cultur…

https://twitter.com/stephaniekelton/status/1258399365284184064?s=21

What prompted this public investment in higher education was neither sentimentality about the poor nor a noblesse oblige of good works. It was a vision of culture and social wealth, derived from the activism of the working classes and defended by a member of Britain’s House of Lords. “Why should we not set aside,” John Maynard Keynes wondered in 1942, “fifty million pounds a year for the next twenty years to add in every substantial city of the realm the dignity of an ancient university.” Against those who disavowed such ambitions on the grounds of expense, Keynes said, “Anything we can actually do we can afford.” And “once done, it is there.”

https://www.newyorker.com/culture/cultural-comment/the-pandemic-is-the-time-to-resurrect-the-public-university?utm_source=twitter&utm_medium=social&utm_campaign=onsite-share&utm_brand=the-new-yorker&utm_social-type=earned

The Pandemic Is the Time to Resurrect the Public University

By Corey Robin May 7, 2020★

私たちにできることは何でも、私たちは余裕を作ることができます– J. W.メイソン

http://jwmason.org/slackwire/keynes-quote-of-day-2/

★

‘Deficit Financing’ or ‘Deficit-Reduction Financing?’.

「赤字融資」または「赤字削減融資?」。

★★

| Stephanie Kelton (@StephanieKelton) |

Extremely good piece from @CoreyRobin newyorker.com/culture/cultur… | |

What prompted this public investment in higher education was neither sentimentality about the poor nor a noblesse oblige of good works. It was a vision of culture and social wealth, derived from the activism of the working classes and defended by a member of Britain’s House of Lords. “Why should we not set aside,” John Maynard Keynes wondered in 1942, “fifty million pounds a year for the next twenty years to add in every substantial city of the realm the dignity of an ancient university.” Against those who disavowed such ambitions on the grounds of expense, Keynes said, “Anything we can actually do we can afford.” And “once done, it is there.”

この高等教育への公共投資のきっかけとなったのは、貧しい人々への感傷性でも、善い仕事への貴族の義務でもありませんでした。 それは、労働者階級の活動主義に由来し、英国の貴族院の一員によって擁護された、文化と社会的富のビジョンでした。 ジョンメイナードケインズは、1942年に、「なぜ私たちが脇に置いてはいけないのか」と疑問に思いました。「今後20年間、年間5000万ポンドで、古代の大学の尊厳をこの分野のあらゆる実質的な都市に加えました」 ケインズは費用の理由でそのような野心を否定した人々に対して、「私たちが実際にできることはすべて、私たちが支払うことができるものです。」と語った。 そして、「完了したら、そこにあります。」

deepL

返信削除リブレ・エクイティ (@LibreEquity)

2019/09/10 4:30

ステファニー・ケルトン@StephanieKelton。

の支払い方法を聞かれたときに

#グリーンニューディールです。

銀行員のようには考えないで

ビーバーのように

via @payforgnd

勉強になります! #LearnMMT #MMT #JobGuarantee pic.twitter.com/D0AXj93hSX

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

ビーバーのように考えなければならない

ビーバーの寓話

https://youtu.be/bn-DeJOfzKA

ということで、まずは簡略化しすぎたことから始めます。

as[Because]簡略化しすぎると、最後に誤解される可能性が低くなると思います。

で、私にはこの問題があるんですよね?

このビーバーには問題があります。

このビーバーは必死に何かを組み立てようとしている。

彼は問題を抱えている。彼は家族の安全を守るために何かを解決したい。

ダムを作りたいんだ どうすればいいか考えないといけない だろ?

どうやって資源を確保するんだ?それで彼は何をした?

彼はリバーバンクに行った!お金を見つけた!

問題はその金をどうやって払うかだ

問題は、どうやってお金を払うのかということです。

ビーバーは現実世界のような

問題、質問、議論...今日ここにいる全員が取り組んでいることです。

ビーバーは単に... 外に出て材料を調達する

この男はエンジニアだ 建築家だ

許可を取る。

法規制検査官だ。全部彼がやるんだ!

彼はそこに行ってこう言うんだ。「この木を倒そう。

枝を取り除く。家族のために生息地を作るんだ

スパを作るんだ 素敵な場所にするんだ。シェルターもある

肉食動物からも安全だ これが俺たちのやり方だよな?

やり方は知ってる 知る必要がある 情報源があるんだ 仕事に取り掛かろう

ダムを作ろう" だろ?簡単だ

ビーバーのように考えよう

グリーン・ニューディールについて 考えたいのです

私は人々が私たちを財源のための戦いに引きずり込むのを 許すのではなく

お金はどこから来るのか...と言いたい。

"どうやってこれを利用するのか 教えてくれと言ってるのか?"

google

返信削除それでは、単純化しすぎたところから始めましょう。

として[あまりにも]単純化しすぎると、最後まで誤解される可能性が少なくなると思います。

だから私はこの問題を正しく持っていますか?

このビーバーに問題があります。

このビーバーは必死に何かを構築したいです。

彼は問題を抱えています。彼は家族を安全に保つために何が必要かを解決したいと考えています。

ダムを建設したい。これに対処する方法を理解する必要があります。正しい?

これをどのように利用しますか?それで彼は何をしますか?

彼は川岸に行きます! [笑い]そしてお金を見つけます!

問題は、それをどのように支払うかです。

私はそれを造る必要があります[ダム-]もちろんそうではありません!正しい。

ビーバーは現実世界の種類に悩む必要はありません

問題-質問-議論-私たちは今日ここで取り組んでいます。

ビーバーは単純に何をしますか?外に出て:資料のリソース。

この男はエンジニアです。彼は建築家です。

彼は許可を取ります。

彼はコードインスペクターです。彼はすべてそれをします!

彼はそこに出て行き、「この木を倒すつもりです。

これらのブランチを削除します。私は家族のための生息地を建設するつもりです。

スパがあります。そして、それは素晴らしい場所になるでしょう。避難所があります。

捕食者から安全です。そして、これは私たちがそれについて取り組むつもりの方法です、そうです。

私はそれを行う方法を知っています。これらのリソースにアクセスできます。仕事に取り掛かりましょう。

私たちはダムを建設します。」正しい?シンプル。

ビーバーみたいに考えて欲しいです。

緑のニューディールについては、このように考えてほしいと思います。

私は、人々が私たちを財源に関する「有償」の戦いに引きずり込むのを許す代わりに私たちが欲しいのです-

お金がどこから来るのか-私に言ってほしい:

[あなたがいるところ]「あなたが 『どうやってそれを支払うつもりか』と言うとき、あなたが本当に求めていること-

あなたは本当に私にこれをどのようにリソースにするかをあなたに言うように本当に頼んでいます。」

のを 許すのではなく

返信削除2019/09/10 4:30

ステファニー・ケルトン@StephanieKelton。

の支払い方法を聞かれたときに

#グリーンニューディールです。

銀行員のようには考えないで

ビーバーのように

via @payforgnd

勉強になります! #LearnMMT #MMT #JobGuarantee pic.twitter.com/D0AXj93hSX

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

ビーバーのように考えなければならない

ビーバーの寓話

https://youtu.be/bn-DeJOfzKA

ということで、まずは簡略化しすぎたことから始めます。

簡略化しすぎているから 最後には誤解される可能性が低くなると思うんです

で、私にはこの問題があるんですよね?

このビーバーには問題があります。

このビーバーは必死に何かを組み立てようとしている。

彼は問題を抱えている。彼は家族の安全を守るために何かを解決したい。

ダムを作りたいんだ どうすればいいか考えないといけない だろ?

どうやって資源を確保するんだ?それで彼は何をした?

彼はリバーバンクに行った!お金を見つけた!

問題はその金をどうやって払うかだ

問題は、どうやってお金を払うのかということです。

ビーバーは現実世界のような

問題、質問、議論...今日ここにいる全員が取り組んでいることです。

ビーバーは単に... 外に出て材料を調達する

この男はエンジニアだ 建築家だ

許可を取る。

法規制検査官だ。全部彼がやるんだ!

彼はそこに行ってこう言うんだ。「この木を倒そう。

枝を取り除く。家族のために生息地を作るんだ

スパを作るんだ 素敵な場所にするんだ。シェルターもある

肉食動物からも安全だ これが俺たちのやり方だよな?

やり方は知ってる 知る必要がある 情報源があるんだ 仕事に取り掛かろう

ダムを作ろう" だろ?簡単だ

ビーバーのように考えよう

グリーン・ニューディールについて 考えたいのです

私は人々が私たちを財源のための戦いに引きずり込むのを 許すのではなく

お金はどこから来るのか...と言いたい。

あなたが本当に求めているのは、「どうやってお金を払うつもりなのか」と言うとき、あなたは本当に私に尋ねている。

"どうやってこれを利用するのか 教えてくれと言ってるのか?"

Libre Equity (@LibreEquity)

返信削除2019/09/10 4:30

Stephanie Kelton @StephanieKelton:

When asked how to pay for a

#GreenNewDeal,

think less like a banker,

and more like a beaver

via @payforgnd

#LearnMMT #MMT #JobGuarantee pic.twitter.com/D0AXj93hSX

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

We Have to Think Like the Beaver

ビーバーの寓話

https://youtu.be/bn-DeJOfzKA

So let me start with an oversimplification.

as if , Because I oversimplify, I think there are fewer chances that I get misunderstood by the end.

So I have this problem right?

This beaver has a problem.

This beaver desperately wants to construct something.

He's got a problem. He wants to solve what's to keep his family safe;

wants to build a dam; needs to figure out how to go about this. Right?

How am I going to resource this? So what does he do?

He goes to the River Bank! [laughter] And finds the money!

The problem is how am I gonna pay for it;

I need to build it[the dam-] no of course not! right.

The beaver does not have to bother himself with the kinds of real-world

problems -- questions -- debates -- that we're all wrestling with here today.

The beaver simply does -- what? Goes out and: resources the materials.

This guy's an engineer. He's an architect.

He pulls the permits, right.

He's the code inspector. He does it all!

He goes out there and he says: “I'm gonna take this tree down.

I'm gonna remove these branches. I'm gonna construct a habitat for my family.

There's gonna be a spa. And it's gonna be a nice place. We're gonna have shelter.

It's gonna be safe from predators. And this is the way we're gonna go about it, right.

I know how to do it: I have to know how. I have access to these resources. Let's get to work.

We build a dam.” Right? Simple.

So I want us to sort of think like the beaver.

That's how I want us to think about the green New Deal.

I want us instead of allowing people to drag us into a “pay-for” fight that is about financial resources --

where the money will come from -- I want us to say:

[ you're at ] “What you're really asking when you say ‘how are you gonna pay for it.

you're really asking me to tell you how I'm gonna resource this.”

Libre Equity (@LibreEquity) 2019/09/10

返信削除@Stephanie Kelton

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

We Have to Think Like the Beaver

ビーバーの寓話

…

So let me start with an oversimplification.

as if , Because I oversimplify, I think there are fewer chances that I get misunderstood by the end.

So I have this problem right?

This beaver has a problem.

This beaver desperately wants to construct something.

He's got a problem. He wants to solve what's to keep his family safe;

wants to build a dam; needs to figure out how to go about this. Right?

How am I going to resource this? So what does he do?

He goes to the River Bank! [laughter] And finds the money!

The problem is how am I gonna pay for it;

I need to build it[the dam-] no of course not! right.

The beaver does not have to bother himself with the kinds of real-world

problems -- questions -- debates -- that we're all wrestling with here today.

The beaver simply does -- what? Goes out and: resources the materials.

This guy's an engineer. He's an architect.

He pulls the permits, right.

He's the code inspector. He does it all!

He goes out there and he says: “I'm gonna take this tree down.

I'm gonna remove these branches. I'm gonna construct a habitat for my family.

There's gonna be a spa. And it's gonna be a nice place. We're gonna have shelter.

It's gonna be safe from predators. And this is the way we're gonna go about it, right.

I know how to do it: I have to know how. I have access to these resources. Let's get to work.

We build a dam.” Right? Simple.

So I want us to sort of think like the beaver.

That's how I want us to think about the green New Deal.

I want us instead of allowing people to drag us into a “pay-for” fight that is about financial resources --

where the money will come from -- I want us to say:

[ you're at ] “What you're really asking when you say ‘how are you gonna pay for it.

you're really asking me to tell you how I'm gonna resource this.”

資料

返信削除https://www.economicpolicyresearch.org/images/docs/research/climate_change/CC_Green_New_Deal_event/Kelton_New_Deal_presentation.pdf

返信削除yoji2020年5月11日 17:48

Libre Equity (@LibreEquity) 2019/09/10

@Stephanie Kelton

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

We Have to Think Like the Beaver

ビーバーの寓話

…

So let me start with an oversimplification.

as if , Because I oversimplify, I think there are fewer chances that I get misunderstood by the end.

So I have this problem right?

This beaver has a problem.

This beaver desperately wants to construct something.

He's got a problem. He wants to solve what's to keep his family safe;

…

The beaver simply does -- what? Goes out and: resources the materials.

This guy's an engineer. He's an architect.

He pulls the permits, right.

He's the code inspector. He does it all!

He goes out there and he says: “I'm gonna take this tree down.

I'm gonna remove these branches. I'm gonna construct a habitat for my family.

There's gonna be a spa. And it's gonna be a nice place. We're gonna have shelter.

It's gonna be safe from predators. And this is the way we're gonna go about it, right.

I know how to do it: I have to know how. I have access to these resources. Let's get to work.

We build a dam.” Right? Simple.

So I want us to sort of think like the beaver.

That's how I want us to think about the green New Deal.

I want us instead of allowing people to drag us into a “pay-for” fight that is about financial resources --

where the money will come from -- I want us to say:

[ you're at ] “What you're really asking when you say ‘how are you gonna pay for it.

you're really asking me to tell you how I'm gonna resource this.”

資料

https://www.economicpolicyresearch.org/images/docs/research/climate_change/CC_Green_New_Deal_event/Kelton_New_Deal_presentation.pdf

返信削除yoji2020年5月11日 17:48

Libre Equity (@LibreEquity) 2019/09/10

@Stephanie Kelton

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

We Have to Think Like the Beaver

ビーバーの寓話

…

The beaver simply does -- what? Goes out and: resources the materials.

This guy's an engineer. He's an architect.

He pulls the permits, right.

He's the code inspector. He does it all!

He goes out there and he says: “I'm gonna take this tree down.

I'm gonna remove these branches. I'm gonna construct a habitat for my family.

There's gonna be a spa. And it's gonna be a nice place. We're gonna have shelter.

It's gonna be safe from predators. And this is the way we're gonna go about it, right.

I know how to do it: I have to know how. I have access to these resources. Let's get to work.

We build a dam.” Right? Simple.

So I want us to sort of think like the beaver.

That's how I want us to think about the green New Deal.

I want us instead of allowing people to drag us into a “pay-for” fight that is about financial resources --

where the money will come from -- I want us to say:

“What you're really asking when you say ‘how are you gonna pay for it.

you're really asking me to tell you how I'm gonna resource this.”

資料

https://www.economicpolicyresearch.org/images/docs/research/climate_change/CC_Green_New_Deal_event/Kelton_New_Deal_presentation.pdf

返信削除yoji2020年5月11日 17:48

Libre Equity (@LibreEquity) 2019/09/10

@Stephanie Kelton

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

We Have to Think Like the Beaver

ビーバーの寓話

…

The beaver simply does -- what? Goes out and: resources the materials.

…

So I want us to sort of think like the beaver.

That's how I want us to think about the green New Deal.

I want us instead of allowing people to drag us into a “pay-for” fight that is about financial resources --

where the money will come from -- I want us to say:

“What you're really asking when you say ‘how are you gonna pay for it.

you're really asking me to tell you how I'm gonna resource this.”

資料

https://www.economicpolicyresearch.org/images/docs/research/climate_change/CC_Green_New_Deal_event/Kelton_New_Deal_presentation.pdf

返信削除yoji2020年5月11日 17:48

Libre Equity (@LibreEquity) 2019/09/10

@Stephanie Kelton

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

We Have to Think Like the Beaver

ビーバーの寓話

…

This beaver … wants to build a dam;

…

The beaver simply does -- what? Goes out and: resources the materials.

…

Let's get to work.

We build a dam.” Right? Simple.

So I want us to sort of think like the beaver.

That's how I want us to think about the green New Deal.

I want us instead of allowing people to drag us into a “pay-for” fight that is about financial resources --

where the money will come from -- I want us to say:

“What you're really asking when you say ‘how are you gonna pay for it.

you're really asking me to tell you how I'm gonna resource this.”

資料

https://www.economicpolicyresearch.org/images/docs/research/climate_change/CC_Green_New_Deal_event/Kelton_New_Deal_presentation.pdf

返信削除yoji2020年5月11日 17:48

Libre Equity (@LibreEquity) 2019/09/10

@Stephanie Kelton

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

We Have to Think Like the Beaver

ビーバーの寓話

…

This beaver … wants to build a dam;

…

The beaver simply does -- what? Goes out and: resources the materials.

…

Let's get to work.

We build a dam.” Right? Simple.

So I want us to sort of think like the beaver.

That's how I want us to think about the green New Deal.

I want us instead of allowing people to drag us into a “pay-for” fight that is about financial resources --

where the money will come from -- I want us to say:

you're at “What you're really asking when you say ‘how are you gonna pay for it’ --

you're really asking me to tell you how I'm gonna resource this.”

資料

https://www.economicpolicyresearch.org/images/docs/research/climate_change/CC_Green_New_Deal_event/Kelton_New_Deal_presentation.pdf

返信削除Libre Equity (@LibreEquity) 2019/09/10

@Stephanie Kelton

https://twitter.com/libreequity/status/1171143737029931009?s=21

https://video.twimg.com/amplify_video/1170904567648833536/vid/1280x720/R1pciP-yplCJoDWi.mp4

We Have to Think Like the Beaver

ビーバーの寓話

…

This beaver … wants to build a dam;

…

The beaver simply does -- what? Goes out and: resources the materials.

…

Let's get to work.

We build a dam.” Right? Simple.

So I want us to sort of think like the beaver.

That's how I want us to think about the green New Deal.

I want us instead of allowing people to drag us into a “pay-for” fight that is about financial resources --

where the money will come from -- I want us to say:

you're at “What you're really asking when you say ‘how are you gonna pay for it’ --

you're really asking me to tell you how I'm gonna resource this.”

資料

https://www.economicpolicyresearch.org/images/docs/research/climate_change/CC_Green_New_Deal_event/Kelton_New_Deal_presentation.pdf

ケルトンのビーバーの寓話と同趣旨のケインズ論考:

返信削除Keynes

How Much Does Finance Matter 1942

金融はどれほど重要なことなのでしょうか

[金融ではなく財政と訳すべきか]

全集27巻所収

多分MMT的には最も重要なケインズのテキストのひとつ

I am sure there have been many listeners who have been muttering :

‘That's all very well, but how is it to be paid for?' (KOW216)

次のようなご不満をおもちの聴取者の方も大勢いらっしゃるものと思い

ます――「みんな大変結構なのだが、どうやってその支払いはなされるの

だろうか」。

Anything we can actually do we can afford. Once done it is there.

われわれが実際に実行できることなら、何でもわれわれは用意することが

できるのです。ひとたび実行されれば、それは存在することになります。

参考

Fiscal fallacies (1): Keynes wanted 'Government loan-expenditures', NOT deficit spending

https://touchstoneblog.org.uk/2015/11/fiscal-fallacies-1-keynes-wanted-government-loan-expenditures-not-deficit-spending/

https://twitter.com/stephaniekelton/status/1258399365284184064?s=21

シートン動物記 第39話 ポプラの森のビーバー

返信削除https://nico.ms/so32217982?cp_webto=share_others_iosapp

ビーバーはLSEのマスコット

返信削除Guest Blog: The LSE Beaver | Students@LSE

https://blogs.lse.ac.uk/studentsatlse/2012/10/25/guest-blog-the-lse-beaver/

Guest Blog: The LSE Beaver★

The Beaver (newspaper) - Wikipedia

https://en.m.wikipedia.org/wiki/The_Beaver_(newspaper)

The Beaver (newspaper)

The Beaver is the fortnightly newspaper of the LSE Students' Union at the London School of Economics, England.

The Beaver has had some of its stories being picked up by the national press. One thousand copies are published and distributed around campus every other Tuesday during term time. Articles are also published online daily. The Beaver is governed its society which is free for any LSE student to join. The paper is made up of sections News, Comment and Features in addition to its magazine Flipside. The Beaver also produces Beaver Sound, a multimedia podcast platform.

なぜこのブログサイトのバナーにエッチングされたビーバーがあるのか疑問に思っている方のために 、LSEビーバーの歴史についてお教えしましょう。

返信削除ビーバーは1922年に学校の公式マスコットとして採用され、同じ年にモットーが選択されました: rerum cognoscere causas – VirgilのGeorgicsから「事物の原因を知ること」を意味する行です。ビーバーは勤勉で勤勉で社交的な動物であり、創設者がLSEの学生が所有し、熱望することを望んでいた属性です。

ビーバーのマスコットを公式に見つけるのは難しいですが(古い建物のアーチの上を除いて)、LSEの学生は毛皮のような友人を決して忘れません。学生が運営するさまざまな組織がマスコットを利用しています。

ポール・スリカー (@psliker)

返信削除2020/05/13 1:00

"今の支出は異常なほどで、一夜にして膨大な予算を通す必要があるため、このお金を得るために誰にも税金をかけていないし、誰からも借りていないことに急に気がついただけです" @ptcherneva

usatoday.com/in-depth/money...

https://twitter.com/psliker/status/1260238508335271937?s=21

返信削除米国はCOVID-19の危機から経済を救うために「刷り込み」をしているが、どこまでできるのか疑問に思う人もいる。

https://amp.usatoday.com/amp/3038117001

2020/05/13

BRENT SCHROTENBOER | USA TODAY | 12時間前

米国はCOVID-19の危機から経済を救うために「刷り込み」をしているが、どこまでできるのか疑問に思う人もいる。

https://amp.usatoday.com/amp/3038117001?__twitter_impression=true

これは新しいことではありません、とチェルネバは言いました。

"それはちょうど今支出が非常に異常であり、我々は一晩で巨大な予算を渡す必要があるので、我々は突然我々がこのお金を得るために誰にも課税していないことを実現している、と我々は誰からもそれを借りていない、" Tcherneva、近々出版予定の本の著者は、"雇用保証のためのケース "と述べました。"政府は自己資金で賄っている"

テルチェネバはポールとは正反対の立場にある。彼女は「現代通貨理論」の提唱者であり、政府はより多くのお金を生み出し、赤字や負債の重要性を最小限に抑えることで、常に支払いを行うことができると主張している。

すべての国がこのようなことができるわけではない-自国通貨を発行している国だけだ。そして、他のどの国も、その財務省証券は、彼らが強力な軍事力を持つ世界的な大国である米国政府の「完全な信頼と信用」に支えられていることが主な理由で、世界的に需要がある米国のように非常に借りることができません。しかし、限界がある。

オックスフォード・エコノミクスによると、2020年3月中旬以降、FRBは現在の危機のために凍結した市場を融解させるために、1.4兆ドルの国債を購入している。

deepl

返信削除

返信削除『貨幣論』における自らの内生的貨幣供給理論を放棄したとは言え、一般理論は今なお指針たり得る

ただしトービンのように読むならばだが…

(その一般理論読解においてヒックスを批判する向きもあるが晩年のヒックスはMMT的には興味深い)

以下ブローグ『ケインズ入門』131頁より

《トービン

『一般理論」の中心的なメッセージは非常に明確なものであると思います。それは

『一般理論」の初めの部分にあります。自由市場に依存することで完全雇用均衡を維持

することは出来ない、というのがそれなんです。自由市場制度にある自力回復(self-

recuperating)やや自己調整(self-adjusting)という特徴は、それらがあまりに非力す

ぎるために、完全雇用均衡を維持することができません。ある時の市場というものが均

衡状態にはなくても、物価の変動が需要と供給の一致を通じて均衡状態をもたらす、と

いう新古典派の信念に対して、ケインズという人が現われ、それは魚市場か米市場につ

いては妥当するかもしれないが、財とサービスとを全体として取り扱う国内市場や海外

市場には当てはまらない、と述べたのです。

ブローグ

それでは、彼の使った多くの概念の中に、ある中心的な理論的概念があった、とおっ

しゃりたいのですか。

トービン

ええ、あったと思います。そこには有効需要の概念がありました。それはその書物の

初めの方でケインズが紹介した中心概念でした。仮説的のもの、また時には後に「観念

的需要」(notional demand)と名付けられたものとは、全く対照的なものとしての有

効需要ですね。その概念はきわめて単純なものです。もしも失業した人々が仕事につけ

ず、賃金が支払われないとするならば、彼等が仕事や賃金を得た場合に買うのと同じ量

の消費財を、彼等が買うと期待するわけにはまいりません。ところがこれに反して、新

古典派の理論は…》

MMT的にはバンコールも興味深いし

さらに以下のケルトンの発言は明らかにケインズ1942を念頭に置いている

Stephanie Kelton - Paying for the Green New Deal - Modern Money Network ...

2019/06

https://youtu.be/5cpCH-SmliY?t=5m7s

同趣旨のケインズ論考:

Keynes

How Much Does Finance Matter 1942

(金融はどれほど重要なことなのでしょうか)

[金融ではなく財政と訳すべきか] 邦訳全集27巻所収

多分MMT的には最も重要なケインズのテキストのひとつ

《I am sure there have been many listeners who have been muttering :

‘That's all very well, but how is it to be paid for?' 》 (KOW216)

(次のようなご不満をおもちの聴取者の方も大勢いらっしゃるものと思います――「みんな大変結構なのだが、どうやってその支払いはなされるのだろうか」。)

ただし例えば晩年のミンスキーはケインズよりも資本主義の不安定性を指摘したカレツキに近付いてゆく…

John Maynard Keynes: How Much Does Finance Matter?

返信削除https://www.bradford-delong.com/2020/05/john-maynard-keynes-how-much-does-finance-matter.html

John Maynard Keynes: How Much Does Finance Matter?

#economics #economicsgoneright #macro #noted #2020-05-30

THE COLLECTED WRITINGS OF JOHN MA YNARD KEYNES: VOLUME XXVII: ACTIVITIES 1940-1946: SHAPING THE POST-WAR WORLD: EMPLOYMENT AND COMMODITIES: EDITED BY DONALD MOGGRIDGE

Downloaded from https://www.cambridge.org/core. Law Library, Osgoode Hall Law School, York University, on 06 Jun 2018 at 05:18:21, subject to the Cambridge Core terms of use, available at https://www.cambridge.org/core/terms. https://doi.org/10.1017/UPO9781139524216

Chapter 5: EMPLOYMENT POLICY

Discussions of post-war employment policy began in the course of 1941. While Keynes was in America, the Treasury had preliminary discussions on post-war internal economic problems, but these petered out before his return as other matters were more pressing. However, the Economic Section of the War Cabinet kept up the momentum. As early as February 1941, James Meade, in the first of a long series of memoranda, had turned to the subject. A later memorandum by Meade, dated 8 July 1941 and entitled 'Internal Measures for the Prevention of Unemployment', along with the preliminary Treasury discussions, played a part in the organisation of an inter- departmental Committee on Post-War Internal Economic Problems in October 1941. This Committee was charged with ascertaining what would be the chief internal problems facing post-war economic policy makers, arranging for memoranda to examine these problems and recommending to Ministers the considerations that they should have in mind in framing policy. Meade's July memorandum was one of the first documents circulated to the Committee. During the early stages of the Committee's work, Keynes himself made a foray into the shape of the post-war world, not for internal Treasury consumption, but as part of a series of BBC broadcasts on post-war planning.

From The Listener, 2 April 1942

HOW MUCH DOES FINANCE MATTER?

For some weeks at this hour you have enjoyed the day-dreams of planning. But what about the nightmare of finance? I am sure there have been many listeners who have been muttering: 'That's all very well, but how is it to be paid for?'

…

https://github.com/braddelong/public-files/blob/master/readings/article-keynes-finance-matter.pdf

https://raw.githubusercontent.com/braddelong/public-files/master/readings/article-keynes-finance-matter.pdf

John Maynard Keynes: How Much Does Finance Matter?

返信削除https://www.bradford-delong.com/2020/05/john-maynard-keynes-how-much-does-finance-matter.html

John Maynard Keynes: How Much Does Finance Matter?

#economics #economicsgoneright #macro #noted #2020-05-30

THE COLLECTED WRITINGS OF JOHN MA YNARD KEYNES: VOLUME XXVII: ACTIVITIES 1940-1946: SHAPING THE POST-WAR WORLD: EMPLOYMENT AND COMMODITIES: EDITED BY DONALD MOGGRIDGE

Downloaded from https://www.cambridge.org/core. Law Library, Osgoode Hall Law School, York University, on 06 Jun 2018 at 05:18:21, subject to the Cambridge Core terms of use, available at https://www.cambridge.org/core/terms. https://doi.org/10.1017/UPO9781139524216

Chapter 5: EMPLOYMENT POLICY

Discussions of post-war employment policy began in the course of 1941. While Keynes was in America, the Treasury had preliminary discussions on post-war internal economic problems, but these petered out before his return as other matters were more pressing. However, the Economic Section of the War Cabinet kept up the momentum. As early as February 1941, James Meade, in the first of a long series of memoranda, had turned to the subject. A later memorandum by Meade, dated 8 July 1941 and entitled 'Internal Measures for the Prevention of Unemployment', along with the preliminary Treasury discussions, played a part in the organisation of an inter- departmental Committee on Post-War Internal Economic Problems in October 1941. This Committee was charged with ascertaining what would be the chief internal problems facing post-war economic policy makers, arranging for memoranda to examine these problems and recommending to Ministers the considerations that they should have in mind in framing policy. Meade's July memorandum was one of the first documents circulated to the Committee. During the early stages of the Committee's work, Keynes himself made a foray into the shape of the post-war world, not for internal Treasury consumption, but as part of a series of BBC broadcasts on post-war planning.

From The Listener, 2 April 1942

HOW MUCH DOES FINANCE MATTER?

For some weeks at this hour you have enjoyed the day-dreams of planning. But what about the nightmare of finance? I am sure there have been many listeners who have been muttering: 'That's all very well, but how is it to be paid for?'

Let me begin by telling you how I tried to answer an eminent architect who pushed on one side all the grandiose plans to rebuild London with the phrase: ' Where's the money to come from?' 'The money?' I said. 'But surely, Sir John, you don't build houses with money? Do you mean that there won't be enough bricks and mortar and steel and cement?'

返信削除'Oh no', he replied, 'of course there will be plenty of all that'.

'Do you mean', I went on,' that there won't be enough labour? For what will the builders be doing if they are not building houses?'

'Oh no, that's all right', he agreed.

'Then there is only one conclusion. You must be meaning, Sir John, that there won't be enough architects'. But there I was trespassing on the boundaries of politeness. So I hurried to add: 'Well, if there are bricks and mortar and steel and concrete and labour and architects, why not assemble all this good material into houses?'

But he was, I fear, quite unconvinced. 'What I want to know', he repeated, 'is where the money is coming from'.

To answer that would have got him and me into deeper water than I cared for, so I replied rather shabbily: ' The same place it is coming from now'. He might have countered (but he didn't): 'Of course I know that money is not the slightest use whatever. But, all the same, my dear sir, you will find it a devil of a business not to have any'.

A question of pace and preference

Had I given him a good and convincing answer by saying that we build houses with bricks and mortar, not with money? Or was I only teasing him?

It all depends what he really had in mind. He might have meant that the burden of the national debt, the heavy taxation, the fact that the banks have lent so much money to the Government and all that, would make it impossible to borrow money to pay the wages of the makers of the raw material, the building labour, and even the architects.

Or he might have meant something quite different. He could have pointed out very justly that those who were making houses would have to be supported meanwhile with the means of subsistence. Will the rest of us, after supporting ourselves, have enough margin of output of food and clothing and the like, directly or by foreign trade, to support the builders as well as ourselves whilst they are at work?

In fact was he really talking about money? Or was he talking about resources in general—resources in a wide sense, not merely bricks and cement and architects?

If the former, if it was some technical problem of finance that was troubling him, then my answer was good and sufficient. For one thing, he was making the very usual confusion between the problem of finance for an individual and the problem for the community as a whole. Apart from this, no doubt there is a technical problem, a problem which we have sometimes bungled in the past, but one which today we understand much more thoroughly. It would be out of place to try to explain it in a few minutes on the air, just as it would be to explain the technical details of bridge- building or the internal combustion engine or the surgery of the thyroid gland. As a technician in these matters I can only affirm that the technical problem of where the money for reconstruction is to come from can be solved, and therefore should be solved.

Perhaps I can go a little further than this. The technical problem at the end of this war is likely to be a great deal easier to handle than it was at the end of the last war when we bungled it badly.

返信削除There are two chief reasons for this:

The Treasury is borrowing money at only half the rate of interest paid in the last war, with the result that the interest paid in 1941 on the new debt incurred in this war was actually more than offset by the relief to national resources of not having a large body of unemployed. We cannot expect that the position will be so good as this at the end of the war. Nevertheless if we keep good employment when peace comes (which we can and mean to do), even the post-war Budget problem will not be too difficult.

And there is another reason also. In 1919 public opinion and political opinion were determined to get back to 1914 by scrapping at the first possible moment many of the controls which were making the technical task easier. I do not notice today the same enthusiasm to get back to 1939. I hope and believe that this time public opinion will give the technicians a fair chance by letting them retain so long as they think necessary many of the controls over the financial machinery which we are finding useful, and indeed essential, today.

What can we afford to spend?

Now let me turn back to the other interpretation of what my friend may have had at the back of his head—the adequacy of our resources in general, even assuming good employment, to allow us to devote a large body of labour to capital works which would bring in no immediate return.

Here is a real problem, fundamental yet essentially simple, which it is important for all of us to try to understand. The first task is to make sure that there is enough demand to provide employment for everyone. The second task is to prevent a demand in excess of the physical possibilities of supply, which is the proper meaning of inflation. For the physical possibilities of supply are very far from unlimited. Our building programme must be properly proportioned to the resources which are left after we have met our daily needs and have produced enough exports to pay for what we require to import from overseas.

Immediately after the war the export industries must have the first claim on our attention. I cannot emphasise that too much. Until we have rebuilt our export trade to its former dimensions, we must be prepared for any reasonable sacrifice in the interests of exports. Success in that field is the clue to success all along the line.

After meeting our daily needs by production and by export, we shall find ourselves with a certain surplus of resources and of labour available for capital works of improvement. If there is insufficient outlet for this surplus, we have unemployment. If, on the other hand, there is an excess demand, we have inflation.

To make sure of good employment we must have ready an ample programme of re-stocking and of development over a wide field, industrial, engineering, transport and agricultural— not merely building. Having prepared our blue-prints, covering the wholefieldof our requirements and not building alone—and these can be as ambitious and glorious as the minds of our engineers and architects and social planners can conceive—those in charge must then concentrate on the vital task of central management, the pace at which the programme is put into operation, neither so slow as to cause unemployment nor so rapid as to cause inflation. The proportion of this surplus which can be allocated to building must depend on the order of our preference between different types of project.

返信削除With that analysis in our minds, let us come back to the building and constructional plans. It is extremely difficult to predict accurately in advance the scale and pace on which they can be carried out. In the long run almost anything is possible. Therefore do not be afraid of large and bold schemes. Let our plans be big, significant, but not hasty. Rome was not built in a day. The building of the great architectural monuments of the past was carried out slowly, gradually, over many years, and they drew much of their virtue from being the fruit of slow cogitation ripening under the hand and before the eyes of the designer. The problem of pace can be determined rightly only in the light of the competing programmes in all other directions.

The difficulty of predicting accurately the appropriate pace of the execution of the building programme is extremely tiresome to those concerned. You cannot improvise a building industry suddenly or put part of it into cold storage when it is excessive. Tell those concerned that we shall need a building industry of a million operatives directly employed—well and good, it can be arranged. Tell them that we shall need a million-and-a-half or two million—again well and good. But we must let them have in good time some reasonably accurate idea of the target. For if the building industry is to expand in an orderly fashion, it must have some assurance of continuing employment for the larger labour force.

I myself have no adequate data on which to guess. But if you put me against a wall opposite a firing squad, I should, at the last moment, reply that at the present level of prices and wages we might afford in the early post-war years to spend not less than £600 million a year and not more than £800 million on the output of the building industry as a whole. Please remember that this includes repairs and current painting and decorations and replacements as well as all new construction, not merely on houses but also on factories and all other buildings. That, for what it is worth, is my best guess. It covers the activities of private citizens, of firms and companies, of building societies, as well as of local authorities and the central government.

Now these are very large sums. Continued, year by year, over a period of ten years or more, they are enormous. We could double in twenty years all the buildings there now are in the whole country. We can do almost anything we like, given time. We must not force the pace—that is necessary warning. In good time we can do it all. But we must work to a long-term programme.

Not all planning is expensive. Take the talk of two months ago about planning the countryside. Nothing costly there. To preserve as the national domain for exercise and recreation and the enjoyment and contemplation of nature the cliffs and coastline of the country, the Highlands, the lakes, the moors and fells and mountains, the downs and woodlands furnished with hostels and camping grounds and easy access—that requires no more than the decision to act. For the community as a whole the expense is insignificant. Or take the question of compensation, which Mr Osborn discussed so clearly and so fairly a fortnight ago. Compensation uses up no resources. It is out of one pocket into another and costs nothing to the community as a whole.

返信削除Even the planning of London to give space and air and perspective costs nothing to the nation's resources and need not involve a charge on the Budget. There is heaps of room, enough and more than enough, in a re-planned London. We could get all the accommodation we need if a third of the present built-up area was cleared altogether and left cleared. The blitz has uncovered St Paul's to the eyes of this generation. To leave it so will cost nothing to the community as a whole. To build may be costly. Let us offset that expense by a generous policy, here and there, of not building.

Where we are using up resources, do not let us submit to the vile doctrine of the nineteenth century that every enterprise must justify itself in pounds, shillings and pence of cash income, with no other denominator of values but this. I should like to see that war memorials of this tragic struggle take the shape of an enrichment of the civic life of every great centre of population.

Why should we not set aside, let us say, £50 millions a year for the next twenty years to add in every substantial city of the realm the dignity of an ancient university or a European capital to our local schools and their surroundings, to our local government and its offices, and above all perhaps, to provide a local centre of refreshment and entertainment with an ample theatre, a concert hall, a dance hall, a gallery, a British restaurant, canteens, cafes and so forth.

Assuredly we can afford this and much more. Anything we can actually do we can afford. Once done, it is there. Nothing can take it from us. We are immeasurably richer than our predecessors. Is it not evident that some sophistry, some fallacy, governs our collective action if we are forced to be so much meaner than they in the embellishments of life?

Yet these must be only the trimmings on the more solid, urgent and necessary outgoings on housing the people, on reconstructing industry and transport and on re-planning the environment of our daily life. Not only shall we come to possess these excellent things. With a big programme carried out at a properly regulated pace we can hope to keep employment good for many years to come. We shall, in very fact, have built our New Jerusalem out of the labour which in our former vain folly we were keeping unused and unhappy in enforced idleness.

返信削除https://twitter.com/libreequity/status/1171143737029931009?s=21

We Have to Think Like the Beaver

上のケルトンによるビーバーの寓話と同趣旨のケインズ論考:

Keynes

How Much Does Finance Matter 1942

金融はどれほど重要なことなのでしょうか

[金融ではなく財政と訳すべきか]

全集27巻所収

多分MMT的には最も重要なケインズのテキストのひとつ

I am sure there have been many listeners who have been muttering :

‘That's all very well, but how is it to be paid for?' (KOW216)

次のようなご不満をおもちの聴取者の方も大勢いらっしゃるものと思い

ます――「みんな大変結構なのだが、どうやってその支払いはなされるの

だろうか」。

Anything we can actually do we can afford. Once done it is there.

われわれが実際に実行できることなら、何でもわれわれは用意することが

できるのです。ひとたび実行されれば、それは存在することになります。

参考

Fiscal fallacies (1): Keynes wanted 'Government loan-expenditures', NOT deficit spending

https://touchstoneblog.org.uk/2015/11/fiscal-fallacies-1-keynes-wanted-government-loan-expenditures-not-deficit-spending/

返信削除https://twitter.com/libreequity/status/1171143737029931009?s=21

We Have to Think Like the Beaver

上のケルトンによるビーバーの寓話と同趣旨のケインズ論考:

Keynes

How Much Does Finance Matter 1942

金融はどれほど重要なことなのでしょうか

[金融ではなく財政と訳すべきか]

全集27巻所収

多分MMT的には最も重要なケインズのテキストのひとつ

I am sure there have been many listeners who have been muttering :

‘That's all very well, but how is it to be paid for?' (KOW216)

次のようなご不満をおもちの聴取者の方も大勢いらっしゃるものと思い

ます――「みんな大変結構なのだが、どうやってその支払いはなされるの

だろうか」。

Anything we can actually do we can afford. Once done it is there.

われわれが実際に実行できることなら、何でもわれわれは用意することが

できるのです。ひとたび実行されれば、それは存在することになります。

参考

Fiscal fallacies (1): Keynes wanted 'Government loan-expenditures', NOT deficit spending

https://touchstoneblog.org.uk/2015/11/fiscal-fallacies-1-keynes-wanted-government-loan-expenditures-not-deficit-spending/

https://twitter.com/stephaniekelton/status/1258399365284184064?s=21

991 名無しさん@お腹いっぱい。[sage] 2020/12/26(土) 23:04:17.89 ID:jmVK8iA7

返信削除https://twitter.com/libreequity/status/1171143737029931009?s=21

”We Have to Think Like the Beaver”

上のケルトンによるビーバーの寓話と同趣旨のケインズ論考:

Keynes

How Much Does Finance Matter 1942

金融はどれほど重要なことなのでしょうか

[金融ではなく財政と訳すべきか]

全集27巻所収

多分MMT的には最も重要なケインズのテキストのひとつ

I am sure there have been many listeners who have been muttering :

‘That's all very well, but how is it to be paid for?' (KOW216)

次のようなご不満をおもちの聴取者の方も大勢いらっしゃるものと思い

ます――「みんな大変結構なのだが、どうやってその支払いはなされるの

だろうか」。

Anything we can actually do we can afford. Once done it is there.

われわれが実際に実行できることなら、何でもわれわれは用意することが

できるのです。ひとたび実行されれば、それは存在することになります。

参考

Fiscal fallacies (1): Keynes wanted 'Government loan-expenditures', NOT deficit spending

https://touchstoneblog.org.uk/2015/11/fiscal-fallacies-1-keynes-wanted-government-loan-expenditures-not-deficit-spending/

https://twitter.com/stephaniekelton/status/1258399365284184064?s=21

https://twitter.com/5chan_nel (5ch newer account)

返信削除ケルトン 2019年6月動画

Stephanie Kelton - Paying for the Green New Deal - Modern Money Network ...

2019/06

https://youtu.be/5cpCH-SmliY?t=5m7s

資料

https://www.economicpolicyresearch.org/images/docs/research/climate_change/CC_Green_New_Deal_event/Kelton_New_Deal_presentation.pdf

ちなみにビーバーはLSEのマスコット

返信削除サカモトハルキ🎙経世済民

@sakamoto1haruki

“経済が生産能力を下回る状態で活動しているのは、社会全体として必要以上に貧しい暮らしをしていることに他ならない。

財政収支が赤字でも利用されていない資源があるのは「支出不足」であることを意味する”

#ステファニー・ケルトン

2021/02/09 19:15

https://twitter.com/sakamoto1haruki/status/1359083447881523201?s=21

返信削除サカモトハルキ🎙経世済民チャンネル

@sakamoto1haruki

“日本は世界の先進国の中で最も借金が多いとよく言われるが、その債務の半分はすでに中央銀行が実質的に回収(償還)しているわけだ。

この割合を一気に100%に引き上げることも簡単だ。

そうすれば日本は世界の先進国の中で最も借金の少ない国になる。

それも一夜のうちに”

#ステファニー・ケルトン

2021/02/08 23:00

https://twitter.com/sakamoto1haruki/status/1358777670058668037?s=12

昨日は、米国経済がどのように永続的に

返信削除過小評価していましたが、確かにその直後に小売売上高の数字が出ました。

見積もりを打ち切られた。

景気が良さそうなので、当然のことながら

FRBが利上げを早める必要があるかどうかの話が多くなっている

支出を減らすべきだとか 物事は

景気が良くなると冷静になる必要があります。

しかし、その答えは、もっと支出を増やして、FRBが緩和することなのかもしれません。

よりも多くの人に知ってもらいたい。結局、経済の「過熱」やインフレの話をすると

エマージング、何の話をしているのでしょうか?私たちは新興について話しています

ボトルネックや、これらを吸収するための生産能力の不足がある。

支出。永続的な投資不足の年の後に、答えは

支出を抑制する

緩和するのか?それとも生産能力を拡大するのが答えなのか?

一般理論』の第22章では(私の同僚マット・ベズラーが

何年も前に投稿された)ケインズは書いた。

それは、もちろん、それが事実であるかもしれません-実際、それは可能性があります-錯覚

ブームの影響で、特定の種類の資本資産が生産されるようになります。

膨大な量の生産物の一部は、どのような場合でも

判断基準、資源の浪費。

ブームがない場合でも、追加します。それは、つまり、誤った方向への

投資を行っています。しかし、それを上回るのが、本質的な特徴である

ブームは、実際には2%の割合で、と言う、利回りになります。

完全雇用の条件では6%の利回りを期待して作られ、それに応じて評価されます。

例えば、6%の利回りを期待して作られ、それに応じて評価される。幻滅が訪れると

この期待は、逆の「悲観論の誤り」に置き換えられており

結果は、実際には2%の利回りを得るであろう投資を

完全雇用の条件では、何も得られないことが予想される。

その結果として、新規投資が崩壊し、その結果として

失業率は、2%の利益を得ているであろう投資である。

完全雇用の状態では、実際には何も得られません。

住宅が不足している状態に到達しますが

敷居の高い家には住めない

があります。

したがって、ブームの救済策は、より高い金利ではなく

低金利! それがいわゆるブームを可能にするかもしれません。

最後に 貿易サイクルのための正しい救済策は

しかし、このようにして、私たちは半スランプの状態に永久的に保たれています。

スランプを廃止し、その結果、私たちを永久に準好況に保つことができます。

Yesterday I wrote about how the U.S economy seems to be perpetually

返信削除underestimated and indeed right after that, we got a retail sales figure that

smashed estimates.

With the economy seemingly ready to cook, naturally there's going to be

more talk about whether the Fed needs to hike interest rates sooner than

planned or that Biden should pare back his spending plans. Things might

get so good that we need to cool things down.

But maybe the answer is to spend even more, and for the Fed to ease

more. After all, when we talk about the economy "overheating" or inflation

emerging, what are we talking about? We're talking about the emergence

of bottlenecks or the lack of productive capacity to absorb all this

spending. After years of perpetual underinvestment, is the answer to

curtail spending (either by raising interest rates) or for the government to

ease back? Or is the answer to expand productive capacity?

In Chapter 22 of The General Theory (which my colleague Matt Boesler

posted years ago) Keynes wrote:

It may, of course, be the case-indeed it is likely to be-that the illusions

of the boom cause particular types of capital-assets to be produced in

such excessive abundance that some part of the output is, on any

criterion, a waste of resources;-which sometimes happens, we may

add, even when there is no boom. It leads, that is to say, to misdirected

investment. But over and above this it is an essential characteristic of

the boom that investments which will in fact yield, say, 2 per cent in

conditions of full employment are made in the expectation of a yield of;

say, 6 per cent, and are valued accordingly. When the disillusion comes,

this expectation is replaced by a contrary 'error of pessimism', with the

result that the investments, which would in fact yield 2 per cent in

conditions of full employment, are expected to yield less than nothing;

and the resulting collapse of new investment then leads to a state of

unemployment in which the investments, which would have yielded 2

per cent in conditions of full employment, in fact yield less than nothing.

We reach a condition where there is a shortage of houses, but

where nevertheless no one can afford to live in the houses that

there are.

Thus the remedy for the boom is not a higher rate of interest but a

lower rate of interest! For that may enable the so-called boom to

last. The right remedy for the trade cycle is not to be found in abolishing

booms and thus keeping us permanently in a semi-slump; but in

abolishing slumps and thus keeping us permanently in a quasi-boom.

My emphasis added as it makes sense today. We actually do have a

返信削除housing shortage, a classic macro situation which some economists might

argue justifies higher rates or total lending. But if there's a housing

shortage, it's because people want houses and there aren't enough, which

seems like an argument to loosen the purse strings such that more are

built. So that demand is so steady that the homebuilders feel the

confidence to match the supply, rather than worry that a slump will come

soon, diminishing the case for investment, leaving the economy overall

under-housed.

For real, I don't have a view on what the Fed or any other entity should do

policy-wise. However, when the talk turns to so-called overheating, it's not

immediately obvious why the fixes always center on draining income from

the private sector, rather than boosting demand and investment in a

sustained fashion, so that the incentive exists to eliminate the bottlenecks

and shortages.

One last point. This need for reinvestment seems crystal clear when

looking at something acute like the crisis in Texas. That will likely create,

for at least some period, upward pricing pressure on a range of goods and

commodities which may further the inflation story. And yet it seems clear

that that the answer is spending more in energy investment (making the

entire system more robust and sustainable) rather than paring back

people's incomes by rate cuts or budget cuts.

今日は意味があるので、私の強調を追加しました。私たちは実際に

返信削除住宅不足は、一部のエコノミストが考えている典型的なマクロ状況である。

議論は金利の上昇や貸し出し総額の増加を正当化するものです。しかし、もし住宅

不足しているのは、人々が家を欲しがっているのに足りないからだ。

より多くの人が

が建てられました。その分、需要は安定しているので、ホームビルダーが感じているのは

不況を心配するよりも、供給に見合う自信がある

すぐに投資のケースが減少し、経済全体が

家が足りない

本当のところ、私はFRBや他の団体が何をすべきかについての見解を持っていません。

政策的には。しかし、話がいわゆるオーバーヒートに変わると

すぐに明らかなのは、なぜ修正は常にから所得を排出することを中心にしています。

の需要と投資を高めるのではなく、民間部門が

ボトルネックを解消するためのインセンティブが存在するように、持続的な方法で。

と不足しています。

最後の一点です。この再投資の必要性は、次のようなときにはっきりとしているように思えます。

テキサスの危機のような急性のものを 見ています それは恐らく創造するでしょう

少なくとも一定期間は、様々な商品の価格上昇圧力と

インフレの話をさらに進める可能性があるコモディティ。それなのに、それは明らかに

答えは、エネルギー投資にもっとお金をかけることだということ(

システム全体がより強固で持続可能なものになるように)。

料金削減や予算削減によって人々の収入が減る。

返信削除Joe Weisenthal

@TheStalwart

IF YOU'RE WORRIED ABOUT INFLATION, WE NEED THE FED TO PRINT MORE MONEY AND THE GOVERNMENT TO SPEND MORE

In today's @markets newsletter, I wrote about the above: The case for more aggressive government stimulus as a response to overheating.

Sign up here: bloomberg.com/account/newsle… pic.twitter.com/mUJm7wA64q

2021/02/18 20:54

https://twitter.com/thestalwart/status/1362369958416703489?s=21

ケインズ1936#22

返信削除https://ello.co/boes_/post/10gbezpmpcmzbzkej8on7g

It may, of course, be the case—indeed it is likely to be—that the illusions of the boom cause particular types of capital-assets to be produced in such excessive abundance that some part of the output is, on any criterion, a waste of resources;—which sometimes happens, we may add, even when there is no boom. It leads, that is to say, to misdirected investment. But over and above this it is an essential characteristic of the boom that investments which will in fact yield, say, 2 per cent in conditions of full employment are made in the expectation of a yield of; say, 6 per cent, and are valued accordingly. When the disillusion comes, this expectation is replaced by a contrary 'error of pessimism', with the result that the investments, which would in fact yield 2 per cent in conditions of full employment, are expected to yield less than nothing; and the resulting collapse of new investment then leads to a state of unemployment in which the investments, which would have yielded 2 per cent in conditions of full employment, in fact yield less than nothing. We reach a condition where there is a shortage of houses, but where nevertheless no one can afford to live in the houses that there are.

Thus the remedy for the boom is not a higher rate of interest but a lower rate of interest! For that may enable the so-called boom to last. The right remedy for the trade cycle is not to be found in abolishing booms and thus keeping us permanently in a semi-slump; but in abolishing slumps and thus keeping us permanently in a quasi-boom.

返信削除https://ello.co/boes_/post/10gbezpmpcmzbzkej8on7g

もちろん、ブームの幻想によって、特定の種類の資本資産が過剰に生産され、生産物の一部がどのような基準であれ、資源の浪費となってしまうこともあるかもしれない。これは、つまり、投資の方向性を誤ることにつながる。しかし、これ以上にブームの本質的な特徴は、完全雇用の状態で実際には2%の利回りが得られるであろう投資が、6%の利回りを期待して行われ、それに応じて評価されていることである。幻滅が訪れると、この期待は逆の「悲観論の誤り」に置き換えられ、その結果、完全雇用の状態では実際には2%の利回りが期待されていた投資が、無よりも少ない利回りになると予想され、その結果生じる新規投資の崩壊は、完全雇用の状態では2%の利回りが期待されていた投資が、実際には無よりも少ない利回りになるという失業状態につながる。住宅が不足しているが、それにもかかわらず、誰も住宅に住む余裕がない状態になるのである。

このように、ブームの救済策は、金利を高くすることではなく、金利を低くすることなのである。そうすれば、いわゆる好景気を持続させることができるかもしれないからだ。貿易サイクルに対する正しい救済策は、ブームを廃止して半スランプ状態を恒久的に維持することではなく、スランプを廃止して準ブーム状態を恒久的に維持することにある。

Deepl

返信削除232 a[sage] 2021/08/26(木) 04:39:37.93 ID:JP5rag+X

返信削除991 名無しさん@お腹いっぱい。[sage] 2020/12/26(土) 23:04:17.89 ID:jmVK8iA7

https://twitter.com/libreequity/status/1171143737029931009?s=21

”We Have to Think Like the Beaver”

上のケルトンによるビーバーの寓話と同趣旨のケインズ論考:

Keynes

How Much Does Finance Matter 1942

金融はどれほど重要なことなのでしょうか

[金融ではなく財政と訳すべきか]

全集27巻所収

多分MMT的には最も重要なケインズのテキストのひとつ

I am sure there have been many listeners who have been muttering :

‘That's all very well, but how is it to be paid for?' (KOW216)

次のようなご不満をおもちの聴取者の方も大勢いらっしゃるものと思い

ます――「みんな大変結構なのだが、どうやってその支払いはなされるの

だろうか」。

Anything we can actually do we can afford. Once done it is there.

われわれが実際に実行できることなら、何でもわれわれは用意することが

できるのです。ひとたび実行されれば、それは存在することになります。

https://twitter.com/5chan_nel (5ch newer account)

返信削除Sam Levey

@SamHLevey

Great excerpt from Keynes, presented by @DEhnts at #MMTSummerSchool22 pic.twitter.com/h46HHjf7y5

2022/08/11 16:48

Dirk Ehnts

Drafting a federal budget from a MMT perspective

John Maynard Keynes, From The Listener, 2 April 1942

HOW MUCH DOES FINANCE MATTER?

For some weeks at this hour you have enjoyed the day-dreams of planning. But what about the nightmare of finance? I am

sure there have been many listeners who have been muttering: 'That's all very well, but how is it to be paid for?'

Let me begin by telling you how I tried to answer an eminent architect who pushed on one side all the grandiose plans to

rebuild London with the phrase: 'Where's the money to come from?' 'The money?' I said. 'But surely, Sir John, you don't

build houses with money? Do you mean that there won't be enough bricks and and steel and cement?'

'Oh no', he replied, 'of course there will be plenty of all that'.

'Do you mean', I went on,' that there won't be enough labour? For what will the builders be doing if they are not building

houses?"

'Oh no, that's all right', he agreed.

Then there is only one conclusion. You must be meaning, Sir John, that there won't be enough architects'. But there I was

trespassing on the boundaries of politeness. So I hurried to add: 'Well, if there are bricks and mortar and steel and concrete

and labour and architects, why not assemble all this good material into houses?'

But he was, I fear, quite unconvinced. What I want to know', he repeated, 'is where the money is coming from'.

To answer that would have got him and me into deeper water than I cared for, so I replied rather shabbily: The same place it

is coming from now'. He might have countered (but he didn't): 'Of course I know that money is not the slightest use

whatever. But, all the same, my dear sir, you will find it a devil of a business not to have any'.

https://www.bradford-delong.com/2020/05/john-maynard-keynes-how-much-does-finance-matter.html

https://twitter.com/samhlevey/status/1557635152779640833?s=21

返信削除サム・レヴィー

サム・リーヴェイ

ケインズからの素晴らしい抜粋、@DEhnts が #MMTSummerSchool22 で紹介しました pic.twitter.com/h46HHjf7y5

2022/08/11 16:48

ダーク・エンツ

MMTの視点から見た連邦予算の立案

ジョン・メイナード・ケインズ、『リスナー』1942年4月2日より

金融はどの程度重要なのか?

この時間帯に何週間か、あなたは計画という白昼夢を楽しんでいる。しかし、財政という悪夢はどうだろうか。私は

とつぶやいたリスナーもいたことだろう。

ロンドン再建の壮大な計画を一方的に押しつけるある著名な建築家に、私がどのように答えようとしたか、まずお話ししましょう。

ロンドン再建の壮大な計画を一方的に押し付けてくる高名な建築家に、「その金はどこから来るんだ」と答えたところ、「金ですか」と言われました。しかし、サー・ジョン、あなたはお金で家を建てたりはしないでしょう。

でも、サー・ジョン、お金で家を建てたりはしないでしょう?レンガや鉄やセメントが足りなくなるということですか?

もちろん、十分な量がありますよ」と彼は答えました。

労働力が足りないということですか?建築屋が家を建てないでどうするんだ。

家を建てないで何をするんだ?

いやいや、大丈夫です」と彼は同意した。

そうなると、結論は一つしかない。建築家が足りなくなるということですね、サー・ジョン」。しかし、そこで私は

礼儀の境界線に踏み込んでしまった。そこで私は急いでこう付け加えました。「レンガとモルタルと鉄とコンクリートと労働力と建築家がいるのなら

労働力と建築家がいるのなら、この良い材料を全部集めて家を作ったらどうだろう?

しかし、残念ながら、彼はまったく納得してくれなかった。私が知りたいのは、そのお金がどこから来るのか、ということだ」と彼は繰り返した。

そう答えると、彼も私も深みにはまってしまいそうだったので、私はややそっけない返事をした。今と同じところです。

と答えた。彼は反論したかもしれない(しかし、しなかった)。もちろん、お金が何の役にも立たないことは知っていますよ。

もちろん、お金が何の役にも立たないことは知っています。しかし、同じように、私の親愛なるサー、あなたは何も持っていない悪魔のようなビジネスを見つけることができます。

https://www.bradford-delong.com/2020/05/john-maynard-keynes-how-much-does-finance-matter.html

https://twitter.com/samhlevey/status/1557635152779640833?s=21